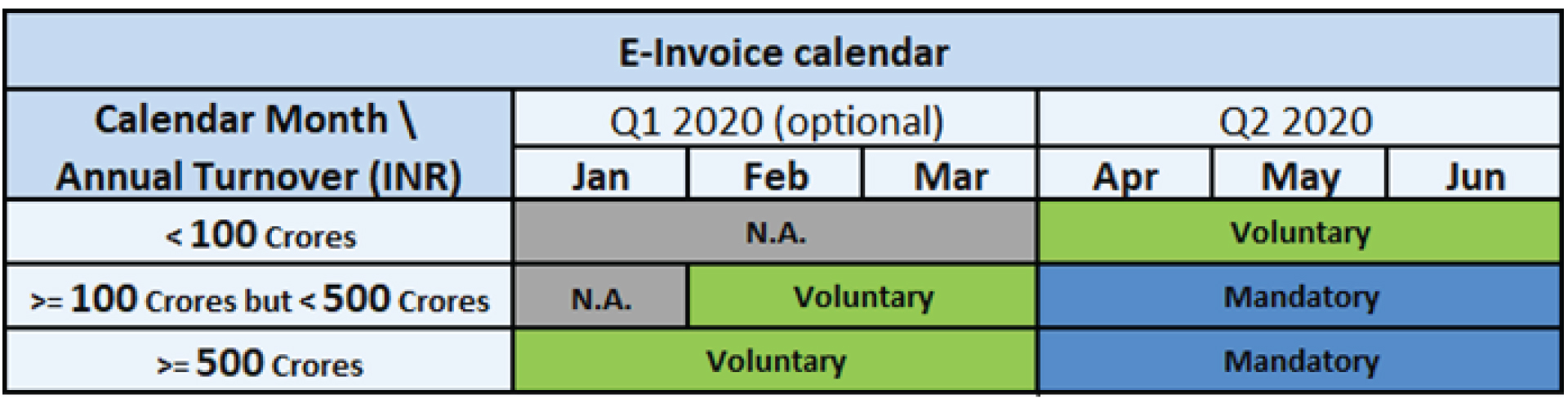

Voluntary e-invoicing

There are taxpayers for whom e-invoicing is voluntary as of April 2020 (based on annual turnover thresholds). We could therefore still have vendor invoices without any e-invoicesto auto-populate the GSTN data. In other words, vendor GST reconciliation would still be relevant for organizations having such vendors in the Accounts Payable cycle.

Changes to e-invoice data

It is best to do the e-invoice generation after ensuring the correctness and completeness of the invoice data. Well, easier said than done. There are several taxpayers who dispatch the goods a day or two after the invoice date. In the exceptional case of any change in invoice data after the e-invoice is generated, what happens next? This can still be handled by way of e-invoice cancellation followed by re-generation of e-invoice with the revised data. However, the e-invoice cancellation can be handled in the IRP provided the cancellation is done within 24 hours of the e-invoice generation.

Beyond 24 hours of e-invoice generation, all further changes have to be handled in GST ANX-1 and not in e-invoice / IRP. Since this possibility exists, there would still be a need for GST Returns solution.

Other sections

E-invoicing is mandatory for specific scenarios:

– Supplier having a specified annual turnover or above

– Customer being a Registered taxpayer or an Export customer

As can be seen above, B2C is exempted from e-invoice.

While QR code is notified to be mandatory for B2C invoices (for all suppliers having annual turnover above 500 Crores), there is no e-invoice for B2C and this QR code is not generated by IRP either. It is the supplier who has to generate the QR code through alternate means and incorporate it in the B2C invoice.

This in turn means that the B2C supply information would not get auto-populated in GST ANX-1 from IRP. Also, a few other sections like imports would also not be available in the auto-populated GST ANX-1. These have to be handled by the GST Returns solution.

Similarly, there could be some information that flows into the ERP often after the invoice is created. The vehicle details (Part B of the E-Way Bill for supply of goods) is one such data. The shipping bill number for Exports is another. These can be handled in E-Way bill / GST Returns solutions, if so required.

Continued

Share this Post