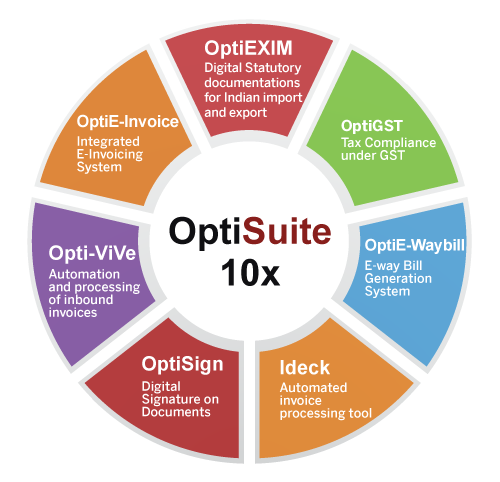

For Business Enterprises

End-to-end GST Solution For Business Enterprises Using SAP ERP

Our customers are able to achieve faster and more efficient documentation and

compliance with the help of OptiSuite range of products

The solution has been developed in IVL’s registered namespace and can therefore be installed and configured without any adverse impact on SAP and other custom-objects in the client’s SAP landscape.

Overview

This software is designed to assist businesses with their GST (Goods and Services Tax) compliance by providing features such as preparation of GST returns, tracking and registering GST-related data, reconciliation of GST transactions, and integration with GSP (GST Suvidha Provider) for electronic filing of GST returns.

IVL has more than two decades of experience in designing SAP Certified Add-ons (Opti range of products). OptiExim handles the scenarios based on current Foreign Trade policy/ regulations. The solution architecture uses native SAP transactions, SAP Enterprise portal & SAPUI5/Fiori applications. OptiExim can be easily integrated with external applications, government portals using APIs

OptiGST Highlights

Major Challenges faced by your business

OptiGST Advantages

Capability and track record

IVL has an integrated ASP solution and is successfully deployed at large number of enterprise customers and being supported under AMC, with periodic support packs addressing changes introduced by GSTN from time to time.

Cost-effective solution

OptiGST seamlessly integrated with SAP ERP eliminating the need for a separate ASP ecosystem. Thereis no need for

additional resources (hardware, manpower) or data movement in file form. The cost of the solution does not increase based on future increase in business volume.

Information security

OptiGST is installed in the same instance as the SAP ERP (on-premise / cloud as the case may be) incorporating encoding and encryption of SAP ERP instance.

Integration with SAP ERP and GSTN

• Automated data extractions from SAP based on configurable identifiers

• Verification & validation controls for authorized users

• Bi-directional data transfer with GSTN initiated from the SAP instance

Blog Posts

IMS demystified

28th March 2025IVL OptiE-invoice: Your Integrated Solution

28th November 2023Important Govt. updates – Mandatory GSTR2B Reconciliation

31st January 2022Interested to know more information about recent developments related to Exim?

Read moreOptiSuite 10x is

certified for deployment on

SAP S/4HANA 2020

A comprehensive Add-on Solution for SAP for meeting various statutory needs in Indirect Taxation, International Trade, Invoicing and more for Indian Enterprises.

ISD & IMS Features in OptiGST

OptiGST empowers businesses with intelligent automation for both Input Service Distribution and Invoice Reconciliation through a unified, AI-enabled platform.

The ISD module identifies eligible purchases at the head office level and distributes Input Tax Credit (ITC) to branch units with distinct GSTINs under the same PAN based on turnover ratio. It auto-generates ISD Annexure and Challan and supports accurate, API-based GSTR-6 filing in compliance with GSTN guidelines.

The IMS Recipient Dashboard offers an AI-powered single-screen cockpit for end-to-end reconciliation. Users can extract and verify SAP purchase data, fetch invoices and GSTR data from the portal, and perform rule-based reconciliation with drill-down views. The system intelligently suggests actions (Accept/Reject/Pending), handles missing entries, and supports automated communication with vendors. Finalized records are stored and pushed to the portal with a single click.

Together, these features streamline GST compliance, reduce manual effort, and improve accuracy through smart automation.

Key Features

- Connector.

GST Returns

. GSTR 1 . GSTR 2A . GSTR 3B

. GSTR 6 . GSTR 9

. ANX-1 . ANX-2 . RET-01

- Connector.

API Based Integration

Save to GSTN

Fetch from GSTN

Filing of Return - Connector.

Vendor Reconciliation

Based on GSTR2A and ANX-2

Flexible Reconciliation criteria

Automated Matching

Manual Pairing for mismatches

Email to vendors

Identifies Defaulting Vendors - Connector.

Input Service Distribution

Distribution of Invoice / Credit Note

ISD Reversals

ISD Challan Print - Connector.

Refund Form

Exporting customers

Deemed Export

Accumulated ITC Refund

GST RFD-01 - claims with centre &state

Annexure 1 Details of Goods

OptiGST Solution has value added features which complement the overall solution.

- Connector.

Data Consolidation

Suitable for Multi Instance ERP Customers

Consolidates Data from Multiple ERPs before Filing

- Connector.

Report Extension

Reconciliation Features with G/L

Accounts in FI Module

- Connector.

Edit Feature

Utility to Edit GST Returns Data

- Connector.

Dashboards & Analytics

Compliance dashboard

Exceptions dashboard

Reconciliation dashboard

MIS Reports - Sales Register

MIS Reports - Purchase Register - Connector.

Ledgers

Cash Ledger

ITC Ledger

Liability Ledger - Connector.

Utilities

Self Service Tools

Search Taxpayer

Get the Return filing Status - Connector.

Tools

Configurable Identifiers

Technical Configurations

API Configurations

Overview

- Helps in GST Returns Preparation

- Registers for Tracking GST Relevant Data

- Reconciliation Features

- GSP Integration for E-filing

Base Scope Highlights

GST Returns

- GSTR1 – Outward Supplies Made by Taxpayer

- GSTR3B – Consolidated Monthly Report

- Inward Supplies Received by a Taxpayer

- GSTR6 – Return for Input Service Distributor

- GSTR2A – Details of vendor Invoices from GSTN portal

- GSTR9 – Annual Return

- Ledgers – Cash/ ITC/ Liability Ledgers

- Search Tax Payer – Fetch details of GSTN no from GSTN portal

- Return Status – Utility for verifying compliance-status

Registers

- Sales Register

- Purchase Register

- Stock Transfer

- FI Register

ISD (Input Service Distributor)

- Distribution of Input Service Credit

- ISD Challan Creation, Maintain & Display

Vendor Reconciliation – Reconciliation of Vendor Invoices (GSTR 2A) with Purchase Register

Roadmap Items

- Simplified Returns

- ANX-1

- ANX-2

- RET-01A

- RET-01

- GSTR7 – Return for Tax Deducted at Source

- Refund Form – RFD-01

- Machine Learning and Natural Language processing for GST insights

- Analytics / Dash Board–Change

- Alerts

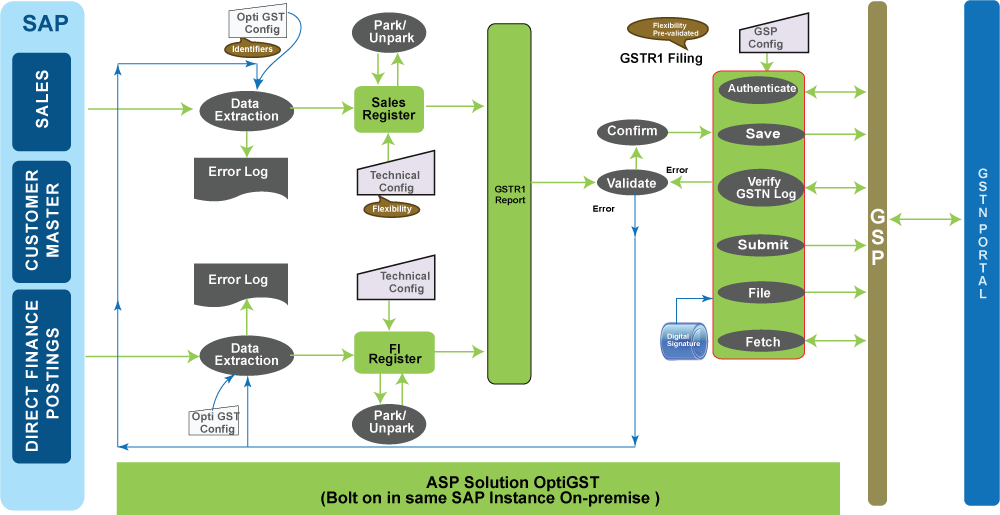

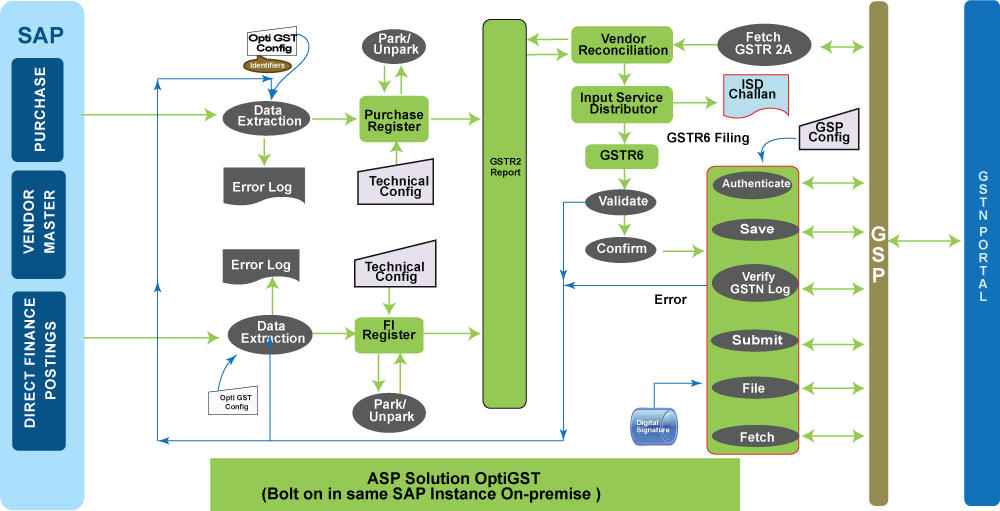

Process Flow

Outward Supply Process Flow

Inward Supply Process Flow

Seamless Integration Across SAP Processes

OptiGST is an add-on product which is deployed on the same server as that of SAP ERP.

OptiGST has a loosely coupled architecture that provides customers with 3 deployment options as per their landscape.

REGULAR Deployment – Suitable for Single Instance SAP ERP Customers.

EMBEDDED Deployment – Suitable for customers having multiple Instance SAP & Non-SAP ERP Environment with one of the SAP ERP instance acting as a HUB.

HUB Deployment – Suitable for customers having huge volumes of data, multiple Instance SAP & Non-SAP ERP Environment with a standalone NetWeaver (with ECC) system acting as a HUB.

Advantages

- On-Premise, SAP Add-On

- No Additional Hardware, No Cloud Subscription, No Technology Upgrade

- No Additional Cost for DB Administration

- No Conflict with SAP or Custom Objects (Separate Namespace)

- Flexible Architecture

- Extensive Configuration Options, Easy to Maintain

- Possible to Handle Combined GST Returns Filing – Covering Multiple SAP/ERP Instances if such Consolidation is Needed (Single GSTN Regn.)

- Can Adapt to Multiple GSPs Who are Conforming to GSTN Guidelines

- Handles GSTN Data-size Restrictions in Terms of Volume of Data per Cycle

- Pre-configured & Pre-validated for Some of the GSPs

- Accelerator to Save Implementation Time

- Best Practices on Custom-Enhancements

- Facilitates Smooth Upgrades and Management of Customizations

- Security

- Authorization

- Data Encryption, Encoding

- Possible to Do End-to-end GST Activities from within SAP ERP

- No need for Interfaces / Download / Upload (For Single Instance Model)

- Automated Data Extraction Based on Configurable Parameters (Background Jobs)

- In-completion Logs after Extraction

- Manual Controls / Verification in SAP before Filing Returns

- Access to GSTN from SAP ERP Itself (GSP Integration)

- Secure GSTN login Credentials/Sessions Using OTP

- SAVE, SUBMIT and FILE GSTR1 Returns in GST Network (FILE Requires Digital Signature)

- Fetch GSTR Data from GST Network

- Quick in Processing of GST Returns from SAP into GSTN

- Reconciliation

- ISD, Refunds

- No Need to Log in to Any Other System or Portal

- Configurable Identifiers for Mapping SAP Identifiers into GSTN Parameters

- Customer Tax Classification, Material Tax Indicator, Document Types, Tax Codes, ISD ratios

- State Code, Unit of Measure, Reason for Debit/Credit Note

- Compliance Status Dashboard/Report

- Internal Audit Report Comparing GSTR 1 and GSTR 2 with G/L

- Training

- User Manuals & Configuration Guide

- Self-Service Tools for Trouble-shooting

- Dedicated Product Team to Handle Statutory Changes, if any, by GSTN / Govt.

- Proven Support Model Under AMC

Value Added Features

OptiGST Solution has value added features which are packaged separately and which complement the overall solution.

Data Consolidation

- Suitable for Multi Instance ERP Customers

- Consolidates Data from Multiple ERPs before Filing

Vendor Reconciliation

- Required for GSTR2 Filing

- Generates Lists of Mismatch Invoices

- Identifies Defaulting Vendors

Report Extension

- Reconciliation Features with G/L Accounts in FI Module

Edit Feature

- Utility to Edit GST Returns Data