For Foreign Trade Management

Smart Manage Your Export & Import Business – The Complete Solution

Our customers are able to achieve faster and more efficient documentation and

compliance with the help of OptiSuite range of products

The solution has been developed in IVL’s registered namespace and can therefore be installed and configured without any adverse impact on SAP and other custom-objects in the client’s SAP landscape. There is no need of additional server or hardware for installing OptiExim. It can be installed in the same instance where SAP is live (on-premise or cloud as the case may be). Specific OptiExim enhancements, if any needed, would be safeguarded from future support packs/ upgrade of OptiExim.

Overview

This solution provides digitalized documentation with alert notifications and analytics to help the corporates to take real-time business critical decisions.

IVL has more than two decades of experience in designing SAP Certified Add-ons (Opti range of products). OptiExim handles the scenarios based on current Foreign Trade policy/ regulations 2023 The solution architecture uses native SAP transactions, SAP Enterprise portal & SAPUI5/Fiori applications. OptiExim can be easily integrated with external applications, government portals using APIs

OptiExim enables you to:-

Major Challenges faced by your business

Advantages of OptiExim

SAP Certified Product

This solution have been tested and validated by SAP

Track and avail export incentives

A tracking mechanism that helps businesses monitor and access export incentives

Track & Monitor

Users can Track and monitor exports and import bills

Accelerating Documentation Processing

Helps in reducing the cycle time for documentation processing

Maximizing Export Capacity

The ability to effectively manage and handle large volumes of exports

Enhance customer experience

Improve the experience for customers

Bank integration through API

Digital readiness (through APIs) for Bank integration related to International payment methods

Digital readiness

To Integrate with the third part Portals Like - DGFT/ICEGATE/Banks through API Interface

Introducing a revolutionary way to transact with Trade APIs

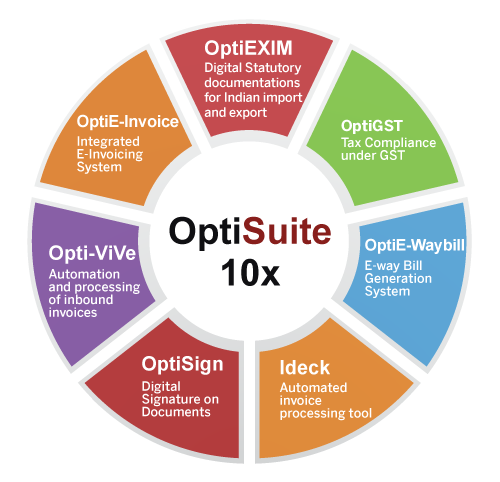

OptiSuite 10x is

certified for deployment on

SAP S/4HANA 2020

A comprehensive Add-on Solution for SAP for meeting various statutory needs in Indirect Taxation, International Trade, Invoicing and more for Indian Enterprises.

Blog Posts

Is Global Trade Operating with Just 3 Documents? Let’s Check the Reality.

15th May 2025Streamlining International Trade: How OptiExim Revolutionizes Export and Import Management

8th August 2024OptiExim: Revolutionizing Foreign Trade Management with SAP Integration

5th February 2024Interested to know more information about recent developments related to Exim?

Read moreKey Features

Imports

- Connector.

Document Set Generation

Pre-Shipment & Post-Shipment Docs

e BRC

- Connector.

Export Obligation of Benefit Schemes

Advance Authorization and EPCG

- Connector.

Trade Finance

Letter of Credit

Advance Payment - e FIRC

Reconciliation of LC with Sales Order

Letter of Credit utilisation

Amendment tracking

Tracking of LC discrepancy charges - Connector.

Post Export Incentive

Duty Drawback – AIR

RoDTEP

IGST Refund Tracking

RoSCTL - Connector.

Container Tracking for Factory stuffing

- Connector.

MIS Reports

- Connector.

Mail Alerts

Integration with SAP ERP and Facility for

Exports

- Connector.

Scheme Management as per Foreign Trade Policy 2023

Advance Authorization, EPCG & RoDTEP, RoSCTL – Application related to DGFT

- Connector.

Trade Finance

Letter of Credit

Advance payment

DA/DP payment

Open account payment

A1 & A2 remittances

Imports bill retirements

Bank Guarantee - Connector.

Vendor Documents

Vendor Document Set

Clearing Instruction

Bill of Entry

Scheme Management

License utilization

Bond Management

Scheme Utilizations through bills of entries. - Connector.

MIS Reports

Functionalities

Exports

- Statutory Document Set Generation for Origin and Destination Country Customs Clearance

- Trade Finance (Letter of Credit, DA, DP, Advance Payment)

- Duty Drawback- All Industry Rate

- CHA Charges Tracking

Imports

- Benefit Schemes (Advance Authorization, EPCG & MEIS) Governed Under India’s Foreign Trade Policy

- Trade Finance (Letter of Credit, DA/DP, Advance Payment, Bank Guarantee)

- Vendor Document Set capture & Clearing Instruction

- Bill of Entry Capture

- Bond

Value Added Services

- IceGate filing

- SAP Enterprise Portal and SAPUI5 / Fiori Applications (Access Over Mobile, Web browser)

- Document Upload in DMS

- Analytics & Dashboard for Export Sales

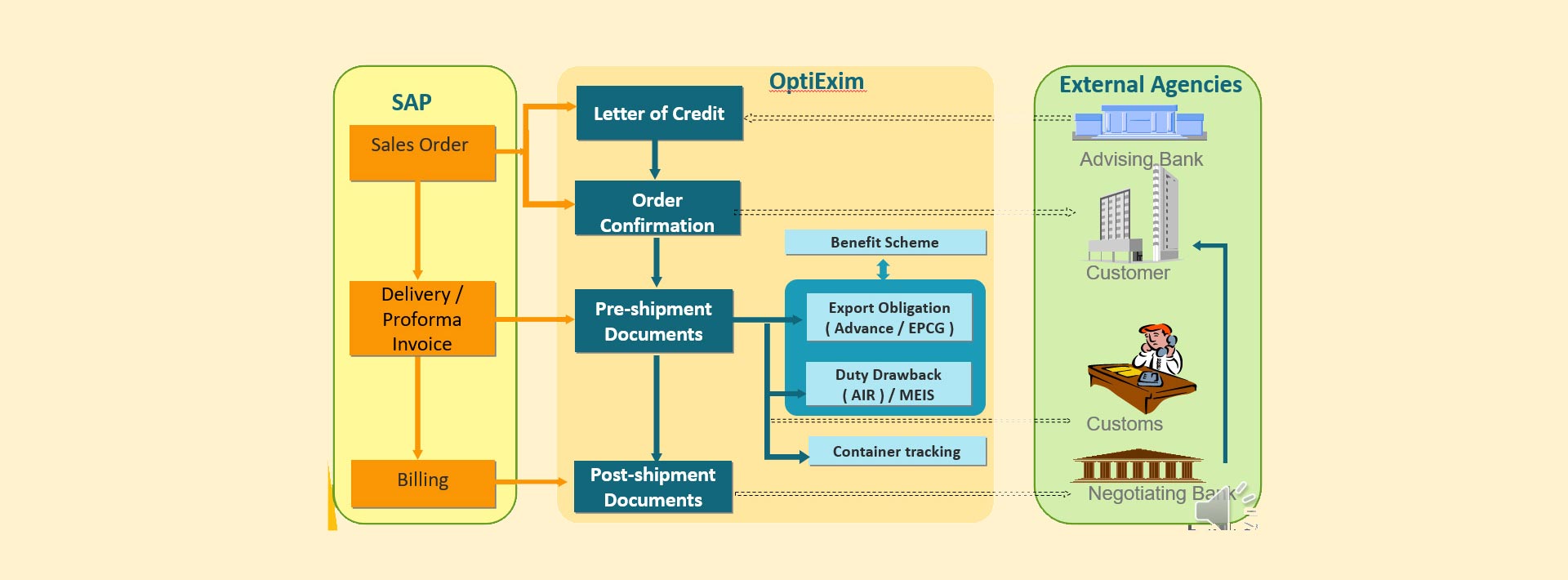

Export Cycle

Exports Document Set

- Splitting and Clubbing of SAP Sales Documents

- Logical Grouping of Capturing Data to Feed Step wise Information

- Tracking Export Obligation (EPCG & Advance Authorization

- Generation of Bank Documents – Letter to Bank, Bill of Exchange

- Generation of Various Pre-shipment and Post Shipment Documents

- Upload Scanned Documents

- Document Customization for Inter company / SEZ/EOU

- Modification of SAP Data in OptiExim for Export Documentation

- Additional Text Entry

- In-completion Log

- Print Action Log

- Customization of Number of Print

- Create Documents With Reference to Another Document

- Export Realization updation through e-BRC details

- e-FIRC tracking for Advance Payment

- Mail Alerts

- MIS Reports

- Exports Register

- Shipping Bill Tracking Report

- Accounts Receivable Report

- Exports Bill Pending for Negotiation

- MEIS Entitlement Reports

Pre-Shipment Documents

- Order Confirmation

- Customs Invoice

- Shipping instruction

- Proforma Invoice

- Packing List

- Bombay Chamber of Commerce Certificate of Origin

- Certificate of Origin for Thailand

- IMC Certificate of Origin

- GSP Certificate of Origin

- ICC Certificate of Origin

- Certificate of Origin -ISFTA

Post-Shipment Documents

- Commercial Invoice & Packing List

- Advance Cargo Declaration

- Export Value Declaration

- Sworn Declaration

- Form 3, Form 7, Form 9

- DEEC Print

- Duty Drawback Declaration-AIR

- Shipping Advice

- Form A2

- Bill of Exchange I & II

- Draft Bill of Lading

- Letter to Bank

Exports Trade Finance

- Tracking of Export Letter of Credit / DA/ DP

- Checklist to Compare the Terms and Conditions of Export Letter of Credit with Sales Order

- Assignment of Sales Order / Contract

- LC Approval Process

- Data Flow from LC Created in SAP

- Mail Alert – LC is Fully Utilized / Expiry Date

- Discrepancy Tracking Report

- Provision to Capture FIRC Details for Advance Payment Received

- Assign Multiple Billing Documents to an FIRC

- Provision to Generate FIRC Request Letter to Bank

Duty Drawback (All Industry Rate)

-

Maintain DBK Rate & DBK Serial Number against SAP

Material Code or MSN code - Upload Data to the DBK Master

- MIS Report Drawback Entitled Amount

- Actual Receipt of Amount Against each Shipping Bill.

- Upload of DBK realization, from the data downloaded from ICE Gate Portal

Container Tracking / Factory Stuffing

- Indent Creation

- Container Arrival Tracking

- Stuffing & Sealing

- Attaching Container to Delivery

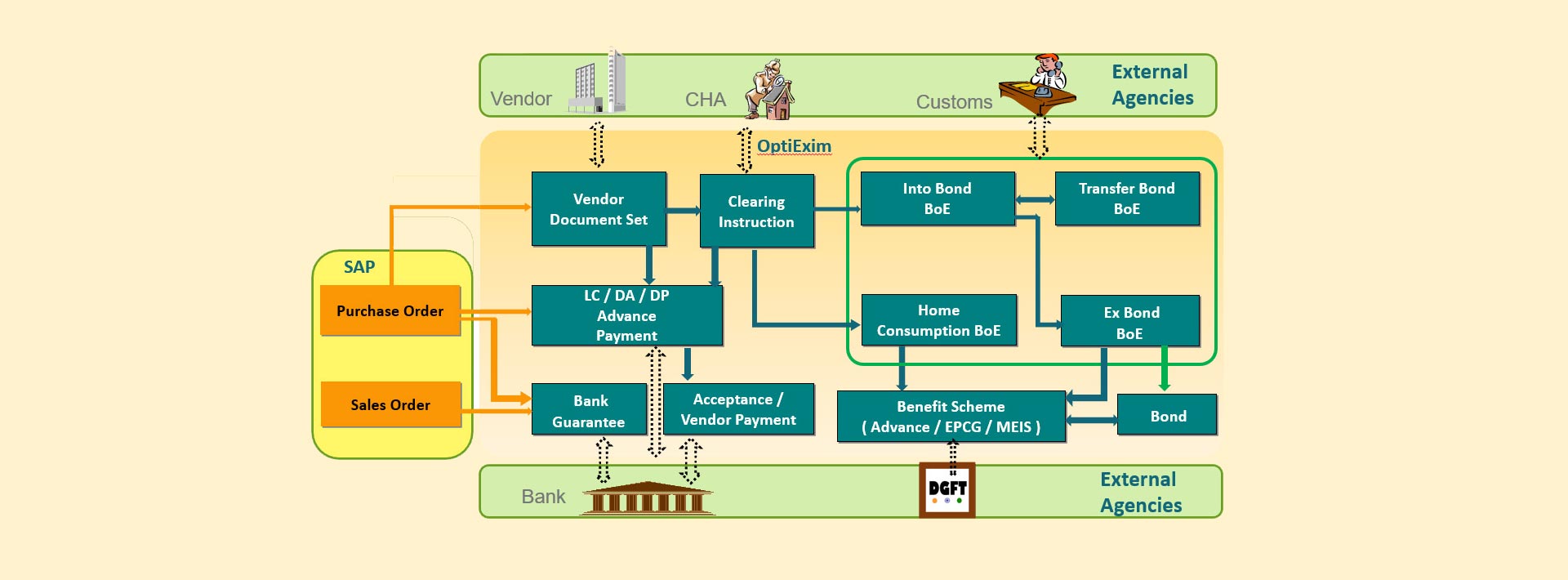

Import Cycle

Benefit Schemes

- Advance Authorization, EPCG , MEIS

- ARO, Invalidation, Enhancement & Re-validation

- Utilization / Fulfillment / Cut over of Open Authorizations

- Attach Scanned Copy of Documents

- EPCG Installation Certificate tracking

- Locking to Control Export Obligation

- Mail alerts – Imports and Export validity against Authorization

- Reports – Advance Authorization, EPCG, MEIS

- SION based Consumption Register for Advance Authorization

- Tracking of Purchase and Sale of MEIS

Imports Trade Finance

- Maintain Bank Limit & Charges

- LC / DA/ DP Application, Document, Amendment

- Acceptance and Retirement

- LC Approval process

- Mail alert – Approval Process and LC Expiry Date

- Track LC Outstanding & Utilization

- Tracking LC Based on the Purchase Order

- Maintain Bank Charges

- Vendor Wise Advance Payment MIS Report

- Bank Guarantee Receipt & Issue

- BG Print Document, Covering Letter, Vacation Letter & Validity Extension Letter

- BG Amendment

- BG Mail Alert for Expiry Date

- Bank Guarantee Tracking MIS report

Vendor Document Set Capture, Bill of Entry & Bond

- Capture Import Related Information Referenced to SAP Purchase Order and Vendor Invoice Items

- Carrier Information, Bill of Lading or Airway Bill (AWB)

- Geographical Information

- Book LC and Benefit Schemes in Document Set

- High Sea Sales

- Track Various Types of Bill of Entry

- Noting and Appraising Process Tracking in Bill of Entry

- Duty Calculation with Benefit Schemes

- Capture CHA charges

- Tracking Various Types of Bonds

- Stock Status in Bonded Warehouse

- Maintenance of Customs Tariff & Notification Master for import Duty Calculation against HSN/SAP Material Code

- Scheme Wise Duty Code Set off Configuration

OptiEXIM : Complete Product Walkthrough

You can also watch specific modules of

OptiExim by following time lines

Introduction

Exports

Imports

OptiExim- Import and Export Software

OptiEXIM is the best software solution for import and export business. OptiEXIM handles entire documentations for Export, Import and Incentive/Licensing/Bonds. Compliant for GST / ICEGATE / CUSTOMS All the required documents (pre and post) for several departments including Banks, RBI, DGFT, Excise and Customs are available and can be generated within few minutes. Our leading-edge software solution has been used by corporates and MNCs for more than a decade. OptiExim works as a perfect solution for all your import and export business needs. It allows you to manage your import/export documentation, export sales and duty drawback, container tracking. OptiExim is a comprehensive software solution that helps you to streamline your import/export business operations.

It automates the entire process of Export & Import, thus reducing the manual efforts and time. It also helps in reducing the cost of compliance and improves the efficiency of the entire process. It provides a single platform for all the stakeholders involved in the Export & Import process. It also helps in tracking the shipments and provides real-time updates.

COMPLIANCE DOCUMENTATIONS:

The platform enables you to create the end-to-end document set which includes all the required documents required for issuance of letter of credit (LC), advance authorization, export incentive duty drawback (EIDDB) or interstate logistics cost reimbursement scheme (ILCR). Apart from this, it also ensures flawless tracking of your exports transactions with multiple actions such as invoice reconciliation, advance authorization and other financial transactions across layers without manual intervention by users.

Easily track letter of credit advance payment, vendor documents and bill of entry. The interface provides direct access to the letters of credit in your account history and provides online reconciliation of LC from sale order letter of credit or forward contract.

OptiEXIM is a powerful, easy to use platform that provides a single point of access to your trade finance documents from an aggregated bank import payment request. With OptiEXIM, you can generate export documentation (export bill) in seconds with little or no investment in technology and then track it with ease right through to end-to-end processing.

Access to Advance Authorization, EPCG & MEIS – under Foreign Trade Policy 2015-2020.

Exports : Pre-shipment documentation for customs clearance

Imports : Customs clearance for Bill of Entry

Banking Documents : Exports post Shipment Documents Outward remittance – A1 & A2

1.Automated Export/Import Documentation:

OptiExim automates the entire export/import documentation process, from creating documents to filing them with the government. It also helps in tracking and monitoring documents.

2. Automated Duty Calculation:

OptiExim helps in calculating duties and taxes accurately and quickly, based on the current foreign trade policy.

3. Automated License Management:

OptiExim helps in managing licenses and permits required for export/import activities, such as IEC, RCMC, etc. It also helps in tracking license validity and renewal dates.

4. Automated Pre-Shipment Inspection (PSI):

OptiExim automates the entire PSI process, from creating documents to filing them with the government. It also helps in tracking and monitoring documents.

5. Automated Logistics Management:

OptiExim helps in managing logistics activities such as freight forwarding, customs clearance, etc., with ease and accuracy.

6. Automated Reporting & Analytics:

7. Real-time insights into export/import activities through comprehensive reports & analytics dashboards.

8. Automated Document Set Generation for Origin and Destination Country Customs Clearance

9. Automated Document Set Generation for Origin and Destination Country Taxation

10. Automated Document Set Generation for Origin and Destination Country Insurance

11. Automated Duty Drawback calculation and filing

12. Automated Duty Drawback reconciliation

13. Automated Duty Drawback claim filing

14. Automated Duty Drawback claim tracking

15. Automated Duty Drawback claim payment

16. Automated Duty Drawback claim dispute resolution

17. Tracking system for CHA charges, allowing users to monitor and manage their CHA costs.

Bill of Entry Capture

Automated Bill of Entry (BOE) capture from Indian Customs EDI system

Automated BOE capture from Indian Customs ICEGATE system

Automated BOE capture from Indian Customs e-Sanchit system

OptiEXIM helps you in the fulfillment of advance authorizations, EPCG, MEIS, export letters of credit and bank guarantees in an easy way. The web based tool has multiple functionality including documents generation, advance authorization and post shipment documents management.

Our pre-shipment & post-shipment documents also facilitate the provision of e FIRC, advance payment, vendor documents, intraday payment/settlement/credit proposals etc.

Advance Authorization: This scheme allows Indian exporters to import inputs for export production without payment of applicable customs duties.

Export Promotion Capital Goods (EPCG): This scheme allows Indian exporters to import capital goods for export production at a concessional rate of customs