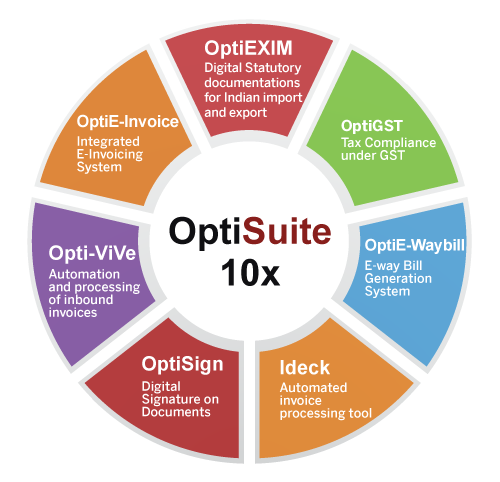

for SAP ECC/S4 HANA system users for India

Integrated E-invoicing System

for SAP ECC/S4 HANA system users for India

Our customers are able to achieve faster and more efficient documentation and

compliance with the help of OptiSuite range of products

The solution has been developed in IVL’s registered namespace and can therefore be installed and configured without any adverse impact on SAP and other custom-objects in the client’s SAP landscape. There is no need of additional server or hardware for installing OptiExim. It can be installed in the same instance where SAP is live (on-premise or cloud as the case may be).

Overview

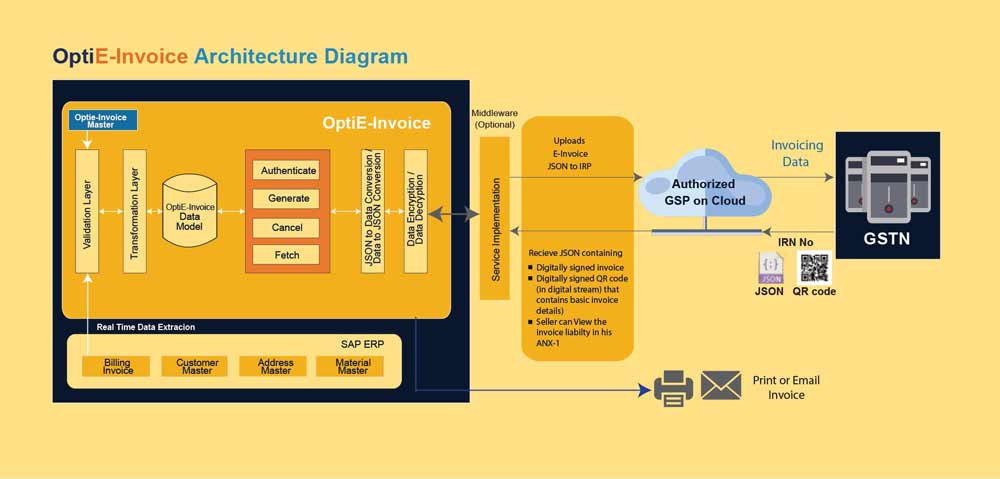

The Indian government has announced the introduction of ‘E-Invoicing’ or ‘Electronic Invoicing’ for reporting of business to business (B2B) invoices to GST System, started from 1st January 2020. It is important that your current ERP system (Like SAP) accordingly allows you to seamlessly generate, submits and files E-Invoices into government portal without additional or manual data entry. The generated E-Invoice follows standard that is also machine-readable and will have uniform interpretation across various stakeholders and the whole business ecosystem. This is a statutory requirement for all business processes to be compliant as per stipulated regulation from the Government. OptiE-Invoice allows the generation of E-Invoice under GST, transmit to Invoice Registration Portal (IRP) via authorized” GSP and receive a unique Invoice Reference Number (IRN), digitally signed E-Invoice and QR code.

OptiE-invoice -Highlights

Major Challenges faced by your business

Advantages of E-Invoice

On-Premise, SAP Add-On

No additional hardware, No cloud subscription

No additional cost for DB Administration

No conflict with SAP or custom objects (separate namespace)

Integration with SAP

Flexible architecture

Extensive configuration options, easy to maintain

Best practices on Custom-Enhancements

Facilitates smooth upgrades and management of customizations

Adaptable to middleware (if so required)

Integration with OptiSign for digital signature

Integration with Innoval’s OptiSign tool

Document signing based on roles

User-friendliness

Easily adaptable to automated processing without manual user steps:

Automated connection / extension of sessions (GSP / IRP)

Automated data validation / transformation / transfer with IRP

Automated capture of IRN & QR code

Ready availability of QR code within SAP landscape (for printing purpose in Invoice)

No need for files to be downloaded / uploaded

Real-time data

Users need to just focus on data exceptions, if any, leaving the rest to automation

Dashboards (SAP Analytics)

Compliance, Exceptions & Insights

OptiSuite 10x is

certified for deployment on

SAP S/4HANA 2020

A comprehensive Add-on Solution for SAP for meeting various statutory needs in Indirect Taxation, International Trade, Invoicing and more for Indian Enterprises.

Blog Posts

IVL OptiE-invoice: Your Integrated Solution

28th November 2023Electronic Invoicing, Are 5 Crore Companies Ready?

29th September 2022Automating Inbound Electronic Invoicing

2nd January 2022Interested to know more information about recent developments related to Exim?

Read moreKey Features

- Connector.

E-invoice generation

E-invoice generation through

OptiE-invoice Cockpit

VF02 Transaction

Automatic / Scheduling - Connector.

E-invoice cancellation

E-invoice cancellation from OptiE-invoice cockpit

Cancelled-status indicator in reports - Connector.

Validation and Log

Configurable validation Rules

API Log for IRN failures

Locking - Connector.

API Based Integration

Authentication with IRP

Generation of E-invoice

Cancellation of E-invoice

Get E-invoice details

Generate E-way Bill by IRN

Reporting & Dashboards*

- Connector.

Compliance dashboard

Pending document count (e-invoice applicable but not generated)

Today’s / Yesterday’s / Prior

Summary of docs at regional level

Details at business place level - Connector.

Exception reporting / Dashboards

Documents having master data modified in SAP after E-invoice generation

Documents cancelled in SAP after E-invoice generation (IRN not cancelled)

Documents active in SAP with E-invoices in cancelled status

Documents modified in SAP after E-invoice generation - Connector.

Validation and Log

Configurable validation Rules

API Log for IRN failures

Locking - Connector.

API Based Integration

Authentication with IRP

Generation of E-invoice

Cancellation of E-invoice

Get E-invoice details

Generate E-way Bill by IRN

- Connector.

Dashboards / Alerts / MIS

Compliance dashboard

Exception dashboard

Status Report

Reconciliation Report - Connector.

Print

Specimen Invoice with

QR Code (IRP)

Digital signature (supplier)

Annexure for e-invoice (optional) - Connector.

Utilities

Validate GST Registration Number (e.g. Customer) – including blocked status

Automated distance calculation for EWB

Manual upload to OptiE-Invoice cockpit (Eg: non-SAP data) - Connector.

Tools

Configurable Identifiers

Technical Configurations

API Configurations

Overview

The Indian government has announced the introduction of ‘E-Invoicing’ or ‘Electronic Invoicing’ for reporting of business to business (B2B) invoices to GST System, starting from 1st January 2020. It is important that your current ERP system (Like SAP) accordingly allows you to seamlessly generate, submits and files E-Invoices into government portal without additional or manual data entry. The generated E-Invoice follows standard that is also machine-readable and will have uniform interpretation across various stakeholders and the whole business ecosystem. This is a statutory requirement for all business processes to be compliant as per stipulated regulation from the Government. OptiE-Invoice allows the generation of E-Invoice under GST, transmit to Invoice Registration Portal (IRP) via authorized” GSP and receive a unique Invoice Reference Number (IRN), digitally signed E-Invoice and QR code.

Optie-invoice a complete SAP E-invoicing software for enterprises with all latest government mandate under GST.

Comply with Mandatory e-Invoicing with SAP E-invoicing Software developed by Innoval Digital Solutions. Optie-invoce – Perfect SAP Partner for GST E-invoicing.

Features

Online API Integration

Benefits

-

On-Premise, SAP Add-On

- No additional hardware, No cloud subscription

- No additional cost for DB Administration

- No conflict with SAP or custom objects (separate namespace)

- Integration with SAP

Flexible architecture

- Extensive configuration options, easy to maintain

- No additional cost for DB Administration

- Best practices on Custom-Enhancements

- Facilitates smooth upgrades and management of customizations

-

Security

- Authorization

- Data Encryption

User friendliness

- No need to log in to any other system or portal for GST E-Invoice generation

Dedicated Product team to handle statutory changes, if any by Govt.

Dedicated help desk team for SLA-driven support under AMC

Architecture Diagram