For Compliance Requirements Under GST

Add-on solutions to SAP ERP for compliance requirements under GST

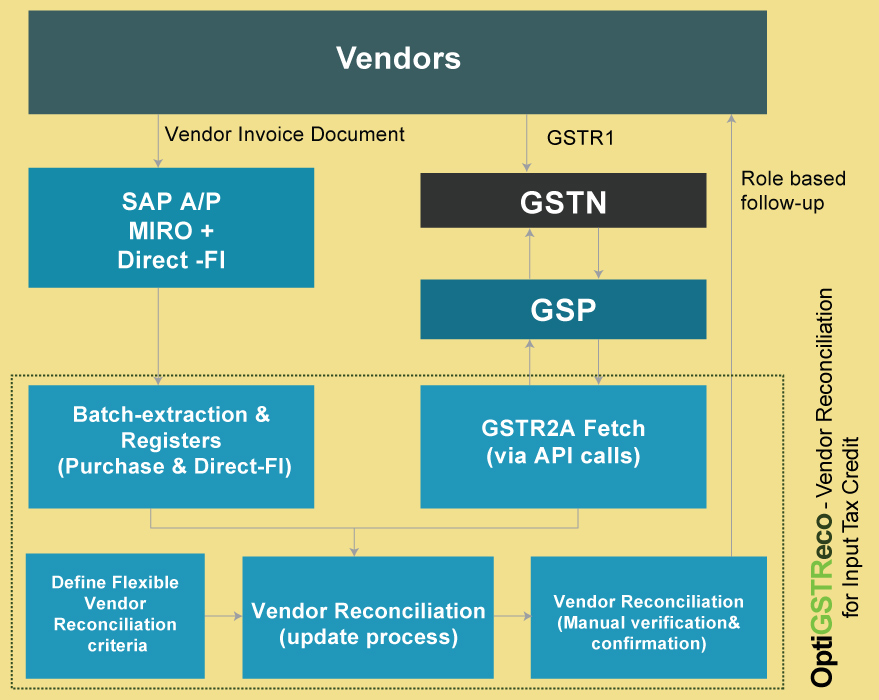

Vendor Reconciliation for hassle-free Input Tax Credit under GST.

Majority of the taxpayers have been availing input tax credit based on vendor invoices posted in their Tax G/Ls. The GST Regime is moving towards allowing input tax credit based on vendor’s GST returns alone, thereby posing a challenge on the cash flow in future as well as reconciliation for previous years. OptiGSTReco is an SAP-Certified Add-On solution that helps business enterprises to do vendor reconciliation in a flexible way and without any file download/upload.

Benefits

OptiGSTReco provides best practices in vendor reconciliation

Features

Registers

Vendor Reconciliation

IVL Value proposition

Capability and track record

Integrated ASP solution successfully deployed at large number of enterprise customers and being supported under AMC, with periodic support packs addressing changes introduced by GSTN from time to time.

Information security

OptiGstReco is installed in the same instance as the SAP ERP (on-premise / cloud as the case may be) incorporating encoding and encryption of data in SAP ERP instance itself.

Cost-effective solution

No need for a separate ASP ecosystem / additional resources (hardware, manpower). The cost of the solution does not increase based on future increase in business volume.