E-invoicing is a new reform which entails the generation of invoices in an electronic format, which facilitates machine readability across ERP and tax systems.

The government has mandated the applicability of e-invoicing to businesses having an annual turnover exceeding INR 500 crore with effect from.1st Oct 2020.

Refer CBIC Notifications mentioned below:

68/2019 | 69/2019 | 70/2019 | 02/2020 | 13/2020 | 60/2020 | 61/2020

Taxpayers exempted from e-invoicing:

- Those having annual turnover below INR. 500 Cr.

- SEZ Units, Insurer, Banking Company, Financial Institution including NBFC, GTA, Supplier of passenger transportation service, Multiplex screens

Type of transactions covered under e-invoicing

- Invoices, Credit Notes and Debit Notes as applicable for

- Outward supplies (goods and services) coming under GST purview

- B2B

- Domestic Sales (intra-state and inter-state)

- Inter-state STO

- Exports

- With pay of IGST & without IGST

- Supply to SEZ (with pay / without pay of IGST)

- Deemed exports

- B2B

- Not applicable:

- B2C (supplies to unregistered dealers or consumers)

- ISD Invoices

- Job Work / Bill of supplies & other documents not coming under GSTR1 purview

- Outward supplies (goods and services) coming under GST purview

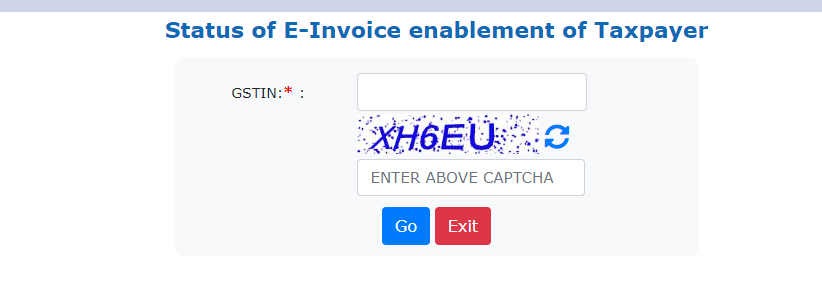

How to find out if a tax-payer is coming under the purview of e-invoicing?

https://einvoice1.gst.gov.in/

Click on Search > e-invoice status of Taxpayer

The different modes of generating the IRN under e-Invoicing:-

- No change in the way Tax invoices, credit notes and debit notes are raised in ERP

- However, the invoice data needs to be registered with the Invoice Registration Portal (IRP), which expects data in a prescribed format (schema) including mandatory fields and conditional-mandatory fields. The final data expected by IRP is in JSON format

- This invoice registration at IRP can be done in multiple ways:

- Directly through system integration from ERP with the e-invoice portal (IRP) via API

- Through system integration (ERP with IRP) via a GST Suvidha Provider (GSP) via API

- Through system integration via an Application Service provider system (ASP) & GSP

- Directly by logging in to the portal (IRP) and manually entering invoice data (proposed)

- Through a combination of an offline tool provided (data entry and conversion to JSON) followed by the bulk upload option in the IRP portal (size limit of 2 MB per upload)

- Note: E-commerce operators can register e-invoices on behalf of supplier

- Invoice Reference Number (IRN)

IRN is generated by IRP, based on:

Seller’s GSTIN

Document Type

Document Number

Financial Year

SHA256 algorithm for IRN

64 digit, alpha-numeric code

- Quick Response code (QR) by IRP

Machine Readable (via prescribed app)

- Supplier GSTIN

- Recipient GSTIN

- Supplier Invoice number

- Date of invoice

- Invoice value

- Number of line items

- HSN Code (Main item)

- IRN

Share this Post