The Indian government has mandated that going forward business needs to authenticate and generate a unique number from government portals.

However, the implementation of the same will be voluntary from 1st January 2020 and mandatory for some size of business from 1st October 2020.

‘E-invoicing’ or ‘electronic invoicing’ is a system in which B2B invoices are authenticated electronically by GSTN/IRP portal of Government of India. This is done by issuing/validating an identification number (IRN) and QR code against every invoice for further use by various Government portal like GSTN or EWay Bill portal.

This will eventually eliminate the need for manual data entry while filing ANX-1/GST returns as well as generation of part-A of the e-way bills and will ease and make compliance process simpler, automated, reduce data errors and will allow interoperability & readability with other systems and most importantly quick settlement of input tax credit.

2. What is the impact of the current system of generating invoices?

All businesses big or small creates invoices through various accounting /ERP software or even thro manual process. These in turn are transmitted as GSTR 1 return thro ASP software like OptiGST. The submitted invoices further get reflected in GSTR-2A for the view of recipients.

Along with the delivery challans, the consignor or transporters also has to generate e-way bill from NIC portal by another software like OptiEWay bill.

All the companies will keep generating the same invoice thro the system however it will be treated legally only once IRN number is generated & authenticated by the government portal.

Hence the current accounting or ERP system need to be changed or integrated with suitable software like OptiE-invoice which prescribes with the prescribed government schema.

The signing of the invoice (manually or digitally by OptiSign) by the companies may still continue in addition to reference of IRN number and QR code on invoice document.

3. What are important elements of e-invoicing under GST?

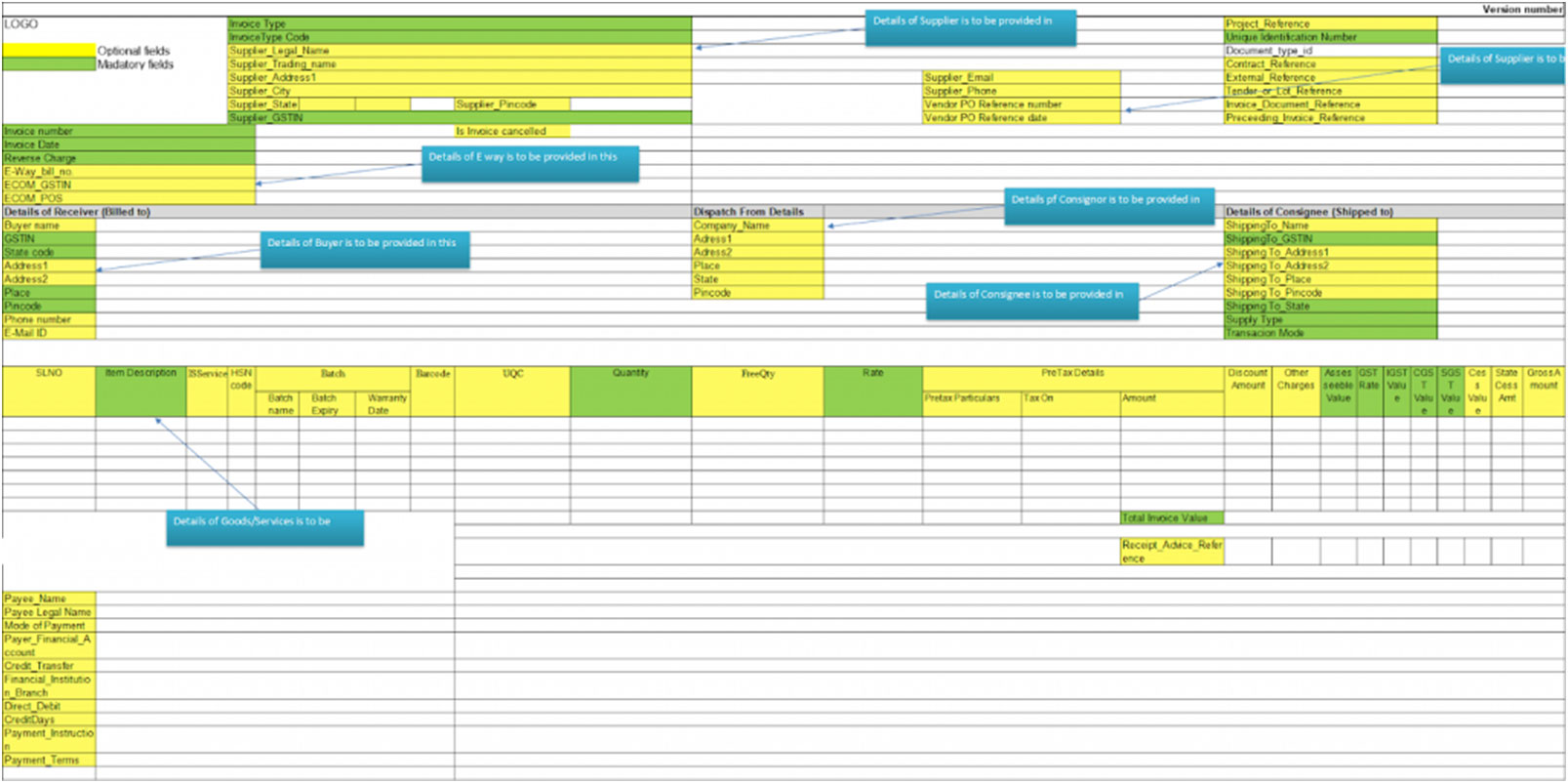

GSTN had released the draft version of e-invoice format in an excel template giving the various informations/field requirements . Some of these fields are compulsory and some ore optionals. Largely the draft format covers requirements of different industries and businesses also closely follows the international and various industry standards.

The GSTN’s e-invoice will contain the following parts:

- E-invoice schema: It consists of the technical field name, description of each field, whether it is mandatory or not, and has a few sample values along with explanatory notes.

- Masters: Masters will specify the set of inputs for certain fields, that are pre-defined by GSTN itself. It includes fields like UQC, State Code, invoice type, supply type, etc.

- E-invoice template: The template is as per the GST rules and enables the reader to correlate the terms used in other sheets. The mandatory fields are marked in green and optional fields are marked in yellow.

4. How to implement an e-invoicing system?

Let’s understand the various steps involved in creating an e-invoice.

- Assess and evaluate and configure your current system to cater to all the mandatory and optional fields requirement as per e-invoice schema (standards).

-

The current functionality of generating an invoice should pass on necessary information and seamlessly integrate with OptiE-invoice software for generating JSON format, IRN and QR code

- OptiE-invoice will get the invoice authenticated and validated by the GSTN portal thro online API process and get newly generated or authenticated IRN and QR code

- The IRN code is essentially generated by a combination of seller’s GSTIN id, invoice number, Financial year (YYYY-YY). There is also ongoing discussion possibility of getting the additional field of document type in future for IRN generation

- The recipient of the supply will also get intimated of the e-invoice generation through email (if provided in the invoice).

- The seller can also send the e-invoice to the recipient in JSON format or printed paper or pdf or email with the logo, IRN, QR code along with various payment terms & conditions. The seller, in addition, can manually sign or digitally sign this e-invoice for sending to recipient

5. How will E-invoicing help government?

It will help in controlling, monitoring and curbing tax evasion in the following ways:

- Since all the business transactions happens real-time compulsorily for the e-invoice , the chances of fake invoices, manipulations will be less.

- Government can allow claims on genuine input tax

- This will improve global rating of india on “Ease of doing business”

6. How does the e-invoice look like?

The e-invoice format is released by GSTN in consultation with the ICAI is as follows:

However, as mentioned earlier, there is no necessity for companies to print all the fields in their printed or signed invoices but it is important the accounting/ERP system passes these data to government portal GSTN/IRP.

7. How to implement e-invoicing system?

At IVL, we are in the business of providing software solutions to various companies in India in the areas of statutory compliance, taxation and documentation.

We have been implementing and providing taxation related software implementation for various companies since the introduction of GST in India from July 2017.

Our consultants can help in providing assessment and evaluation of your current system and suitably advise on the various changes that need to be adopted in your current accounting/ERP/SAP system

We will install and configure and implement OptiE-invoice system using our proven methodologies to seamlessly connect with your current system.

Please get in touch with our regional teams for further information.

Share this Post