Transfer Pricing

Transfer pricing is the price at which one entity transfers or transact supplies/ Goods to another entity. In other words, transfer pricing is the price which is paid for goods or services transferred from one unit of an organization to its other units situated in different countries. Transfer prices are used when individual entities of a larger multi-entity firm are treated and measured as separately run entities.

A transfer price arises for accounting purposes when related parties, such as divisions within a company or a company and its subsidiary, report their own profits. When these related parties are required to transact with each other, a transfer price is used to determine costs.

For example, assume entity A and entity B are two unique segments of Company ABC. Entity A builds and sells wheels, and entity B assembles and sells bicycles. Entity A may also sell wheels to entity B through an intracompany transaction. If entity A offers entity B a rate lower than market value, entity B will have a lower cost of goods sold (COGS) and higher earnings than it otherwise would have. However, doing so would also hurt entity A’s sales revenue.

If, on the other hand, entity A offers entity B a rate higher than market value, then entity A would have higher sales revenue than it would have if it sold to an external customer. Entity B would have higher COGS and lower profits. In either situation, one entity benefits while the other is hurt by a transfer price that varies from market value.

For better understanding the effect of transfer pricing on taxation, let’s take the example with entity A and entity B. Assume entity A is in a high tax country, while entity B is in a low tax country. It would benefit the organization as a whole for more of the Company ABC’s profits to appear in entity B’s division, where the company will pay lower taxes. In that case, the Company ABC may attempt to have entity A offer a transfer price lower than market value to entity B when selling them the wheels needed to build the bicycles. As explained above, entity B would then have a lower cost of goods sold (COGS) and higher earnings, and entity A would have reduced sales revenue and lower total earnings.

The following are some of the typical international transactions which are governed by the transfer pricing rules:

- Sale of finished goods;

- Purchase of raw material;

- Purchase of fixed assets;

- Sale or purchase of machinery etc.

- Sale or purchase of Intangibles.

- Reimbursement of expenses paid/received;

- IT Enabled services;

- Support services;

- Software Development services;

- Technical Service fees;

- Management fees;

- Royalty fee;

- Corporate Guarantee fees;

- Loan received or paid.

The key objectives behind having transfer pricing are:

- Generating separate profit for each of the divisions and enabling performance evaluation of each division separately.

- The entities can obtain segmented P &L and Balance sheet based on the single entity.

- Transfer prices would affect not just the reported profits of every centre, but would also affect the allocation of a company’s resources (Cost incurred by one centre will be considered as the resources utilized by them).

- Transfer prices that differ from market value will be advantageous for one entity, while lowering the profits of the other entity.

- Multinational companies can manipulate transfer prices in order to shift profits to low tax regions.

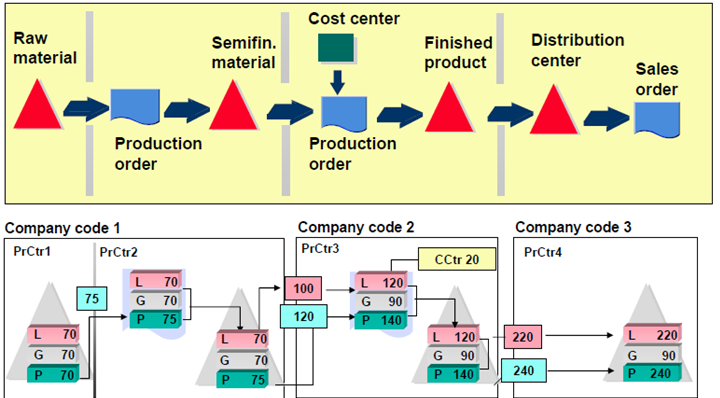

For the purpose of management accounting and reporting, multinational companies (MNCs) have some amount of discretion while defining how to distribute the profits and expenses to the subsidiaries located in various countries. Sometimes a subsidiary of a company might be divided into segments based on Profit center, plant, sales organization or might be accounted for as a standalone business. In these cases, transfer pricing helps in allocating revenue and expenses to such subsidiaries in the right manner.

The profitability of a subsidiary depends on prices at which the inter-company transactions occur. These days the inter-company transactions are facing increased scrutiny by the governments.

Transfer Pricing Methods

- Market-based transfer prices

The subsidiary company transfer products at prices prevalent in the market for that product. - Cost-based transfer prices

The subsidiary company transfers product at its cost plus a margin - Negotiated transfer prices

The subsidiary company agree between themselves the price at which the transfer should take place.

SAP’s Transfer Pricing Mechanism

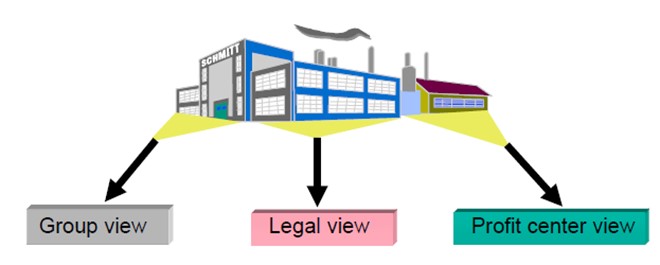

SAP transfer price is triggered by transfer of products or services between profit centers. So, Profit Center Accounting should be active

- Accounting for Transfer Price is reflected in a “profit center view” in Financial Ledgers

- SAP Material Ledger allows multiple valuation view (group, profit center) of group currency.

- The legal view is always in company code currency for legal reporting purposes

- Profit Center view is used to reflect additional accounting entries for Transfer Price. That way, customers can select the appropriate view to fulfill reporting requirements.

1. Cost and profit centre list along with their functions/definitions

Cost Center

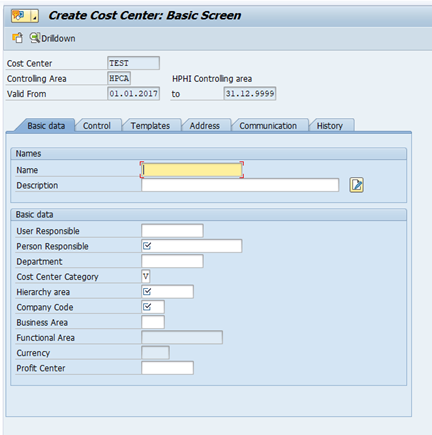

Cost center is mandatory for every plant were transfer pricing happens. Cost center in SAP brings up the cost incurred for the production of the Good.

In the above figure, it shows the cost center is giving the cost incurred while production and it is adding with the goods price. The costs includes material cost, manpower costs and other direct and indirect costs incurred. The cost center details will get from SAP through the Tcode KS03. The screen will be like follows

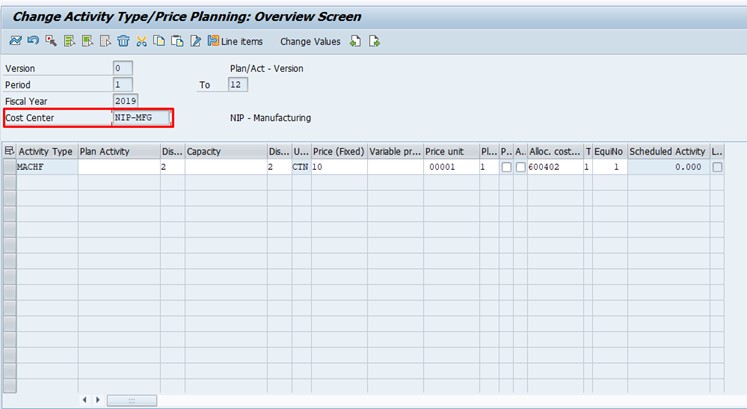

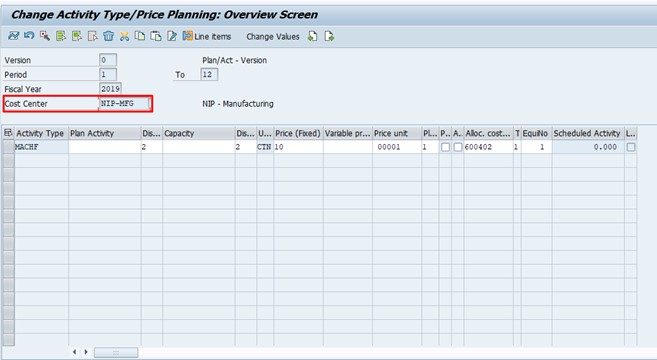

Please find the below screenshot of the Tcode KP26. Through KP26, SAP will add the activity cost during the production. Thus after the production order, the material price will be getting finalized.

In the above figure, it shows the cost center is giving the cost incurred while production and it is adding with the goods price. The costs includes material cost, manpower costs and other direct and indirect costs incurred. The cost center details will get from SAP through the Tcode KS03. The screen will be like follows

Profit Center

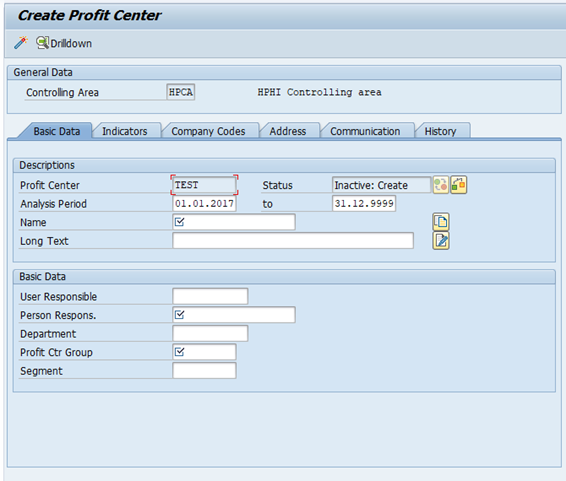

Profit center is one of the important aspect in Transfer pricing. Through profit center only the tranfer pricing profit or loss of the sending plant as well as the receiving plant can be arrived. Please make a look in to the Profit center screen.

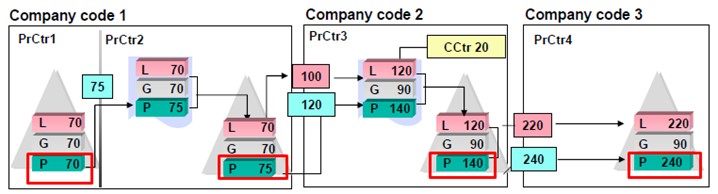

Profit Center view is one of the important views in Transfer Pricing. In every transfer pricing scenario, profit center acts as a driving force of reporting of plant based analysis.

The profit center based pricing is considered as the management price fixing during the process. The profit center based prices will differ from plant to plant

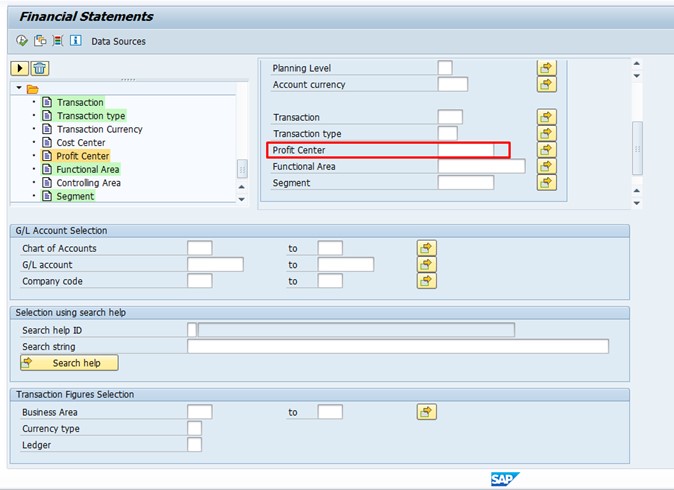

In the above picture, it clearly shows the profit center based prices. Finally, the profit center shows the internal sales is at profit or at loss. Profit centers earn profits like independent companies. For reporting purposes also profit center is important in SAP. In the below screenshot it is clearly depicted that the Financial Statements can be generated on Profit center wise.

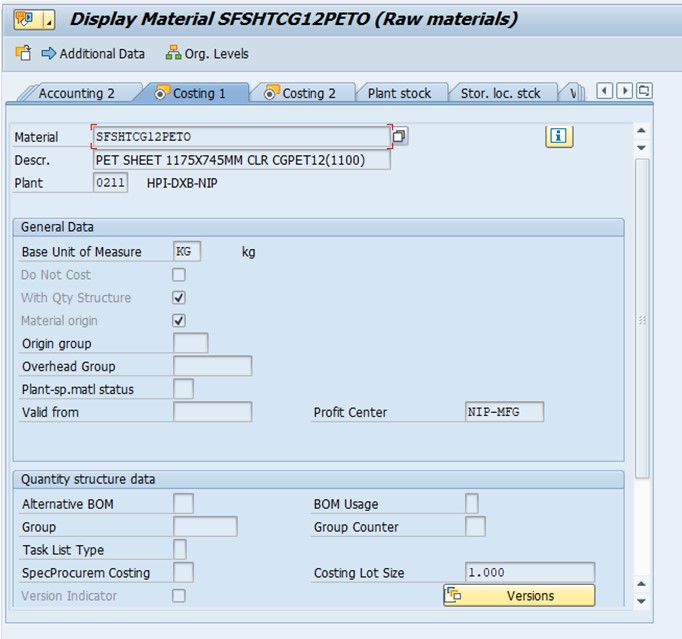

The profit center is defined in the material master for better flow of values during costing. During all production orders, this profit center will be getting picked for better and crisp reporting without any flaw.

The Transfer of Goods can happen within the plant from one profit center to another. Or it can be through different plant and different profit center. There are a lot of combinations in transfer pricing related to the profit center.

2. Cost and profit centre list along with their functions/definitions

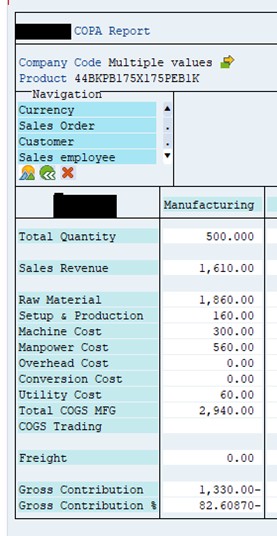

Here we can see the total quantity, how much sales revenue we got, the costs like material, setup and production, Machine cost, Overhead Cost, Utility Costs. And finally we can see the contribution made. This can be filtered based on the Product, Plant, Profit center etc. For Transfer Pricing, we can get individualized sender/receiver plant/profit center reports.

3.Allocations of costs with different categories and weightages on pricing

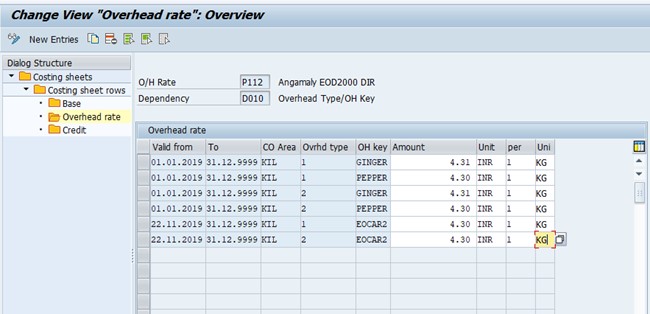

Allocation of Costs will be based on the Cost center activity cost allocations or through the Overhead cost allocations. Activity Cost allocation will be based on the cost center only. Please see the screenshot.

The cost center allocation will be based on the Overhead key which is defined in SAP. This overhead rate is connected to the material based on the Overhead key defined in material master. Please find the below screenshot.

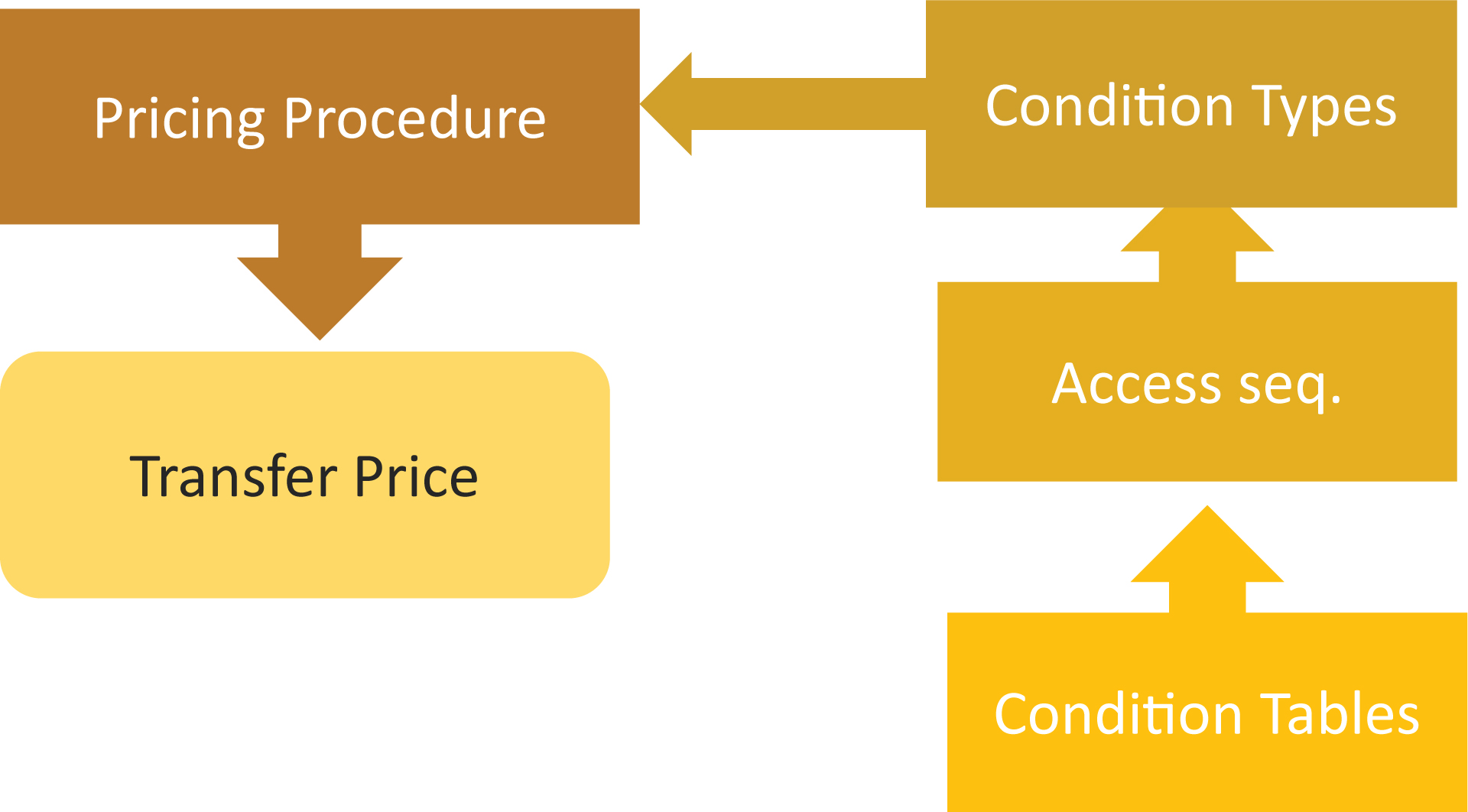

The Weightages on pricing will be given through condition procedures and pricing procedures. The prices of tranfer pricing can be a fixed price or a percentage in addition to the standard price, which is known as Markup Price.

Share this Post