The Finance Bill, 2021 has proposed to introduce a new section 194Q to the Income-tax Act, 1961 which requires a buyer to deduct tax at source in case of purchase of goods, the value or aggregate value of which, exceeds INR 50 Lakh in a financial year.

The provisions of this section would come into effect from 01-Jul-2021 and would apply to a buyer, whose total sales, gross receipts or turnover from the business carried on by him exceeds INR 10 Crore during the financial year immediately preceding the financial year, in which the goods are purchased.

It further provides that such tax is to be deducted on the purchase of goods only from a seller, who is a resident of India under the provisions of the Act. The rate prescribed for deduction of tax is 0.1% of the value or aggregate value of the goods that exceeds INR 50 lakh in the financial year.

Tax would be required to be deducted at a higher rate of 5%, if the seller does hold a PAN in India. Enabling amendment would be carried out to the provisions of section 206AA of the Act.

As applicable in the case of other TDS provisions, liability to deduct tax would arise at the time of credit or receipt of payment, whichever is earlier and would include any sum credited to any account, whether called by the name “suspense account” or by any other name.

The above provision of deduction of tax at source on purchase of goods is not applicable in the following cases:

- where tax is deductible under any of the provisions of the Act; and

- where tax is collectible under section 206C of the Act except to transaction covered under section 206C(1H);

It is to be noted that if a transaction is subject to the provisions of both TDS and TCS, the purchaser is first liable to deduct TDS. As we mainly observe from the regulation that TDS is deducted by the purchaser and FICA system mainly captures the sales transaction. Hence, TDS is not supported in FICA for this scenario.

Applicability of TDS Section 194Q

What are the changes required in the accounting systems or ERP or SAP application of the buyer & Seller?

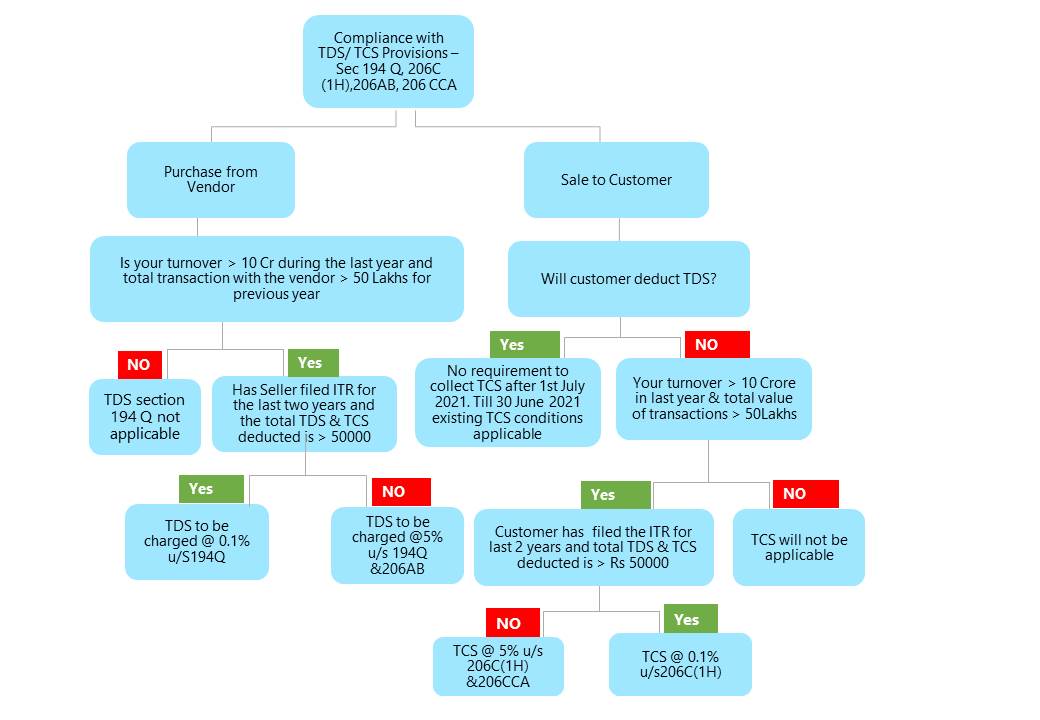

Some of the Typical applicability questions related to TCS and TDS Scenarios:

Let us say, Mr. A purchased goods on credit for INR 40 Lakh in the Year 1 and for INR 35 lakh in Year 2. Entire payment for the above two consignments were made in Year 2. In such case, there would not arise any TDS requirement under section 194Q for any of the above years since the purchase made for any of these years do not exceed INR 50 lakh. The threshold of INR 50 lakh is to be reckoned based on the amount of purchase in a year and not the amount of consideration or advance paid in a year.

The provisions of section 194Q take forward the objective of the Government towards widening and deepening tax base. It is ostensible that the main intention behind the bringing out the provision of 206C(1H) or this newly proposed section 194Q, is not to recover taxes but to widen the tax base.

Sub-section (5) of section 194Q provides for non-applicability of the provision in cases where tax is required to be deducted or collected under any other provisions of the Act except the transaction referred to in section 206C(1H) of the Act. This would mean that while determining liability to deduct tax at source of purchase of goods, one should first assess whether any other provision relating to deduction or collection of tax at source is applicable for such transaction. If the answer is yes, then tax should be deducted or collected in accordance with that section and not as per the provision of section 194Q.

Though, the non-applicability of section 194Q is not extended to the transactions covered under section 206C(1H) of the Act, the second proviso to section 206C(1H) of the Act reads as under:

Provided further that the provisions of this sub-section shall not apply, if the buyer is liable to deduct tax at source under any other provision of this Act on the goods purchased by him from the seller and has deducted such amount.

What emanates from the above is that if a buyer is liable to deduct tax at source under any other provision of the Act on the goods purchased by him and deducts such amount then such transaction will not again suffer collection of tax at source under section 206C(1H) of the Act. Thus, provisions of section 194Q and the provisions of section 206C(1H) are mutually exclusive.

The question whether the purchase made prior to 01st July 2021 during FY 2021-22 is to be considered while computing the threshold of INR 50 lakh or not, is yet to be addressed by the Central Board of Direct Taxes (CBDT).

As a prudent measure, it is advisable that for the purpose of reckoning the threshold of INR 50 lakh, the purchase/s made prior to 01st July 2021 during FY 2021-22 shall be included. At same breath, it is also added that where the purchases made prior to 01st July 2021 already exceeded INR 50 lakh, the buyer need not to do TDS on that excess amount while paying or crediting further consideration to the account of the seller on or after 01st July 2021.

We also wish to make a mention that the CBDT vide its Circular No. 17 of 2020 while clarifying identical issue in case of application of section 206C(1H) of the Act, which came into effect from 01-Oct-2020 had mentioned that for the purpose of reckoning the threshold, consideration received from 01-Apr-2020 shall be considered.

Example Scenarios Applicability of TDS u/s 194 Q

SAP has provided Notes for Both TCS and TDS. The TCS notes were released previously and there are some additions to the TCS notes which need to be implemented before 1st July 2021. These TCS notes would allow customers to decide on TDS or TCS applicability.

Some of the Typical Questions which any SAP user would encounter are a below:

In order to be able to close the open invoices on payment receipt users can post the balance amount which buyer has deducted to a separate TDS account and clear it manually after receipt of TDS certificate from buyers by end of every quarter.

So one should not post goods and service together in the same invoice.

So it is suggested to post separate invoices for such purchases

So when you maintain the value under Exempt. threshold column in TAN exemption tab ensure that you have considered all the invoices, downpayments, credit notes, debit notes, cancelation entries, any litigation documents for the supplier that you want to exclude and then update the value.

There is no standard report to arrive at the values as this will be used only for this FY.

So when you maintain the value under Exempt. threshold column in TAN exemption tab ensure that you have considered all the invoices, downpayments, credit notes, debit notes, cancelation entries, any litigation documents for the supplier that you want to exclude and then update the value.

There is no standard report to arrive at the values as this will be used only for this FY.

Example: If the purchase consideration (including invoices, downpayments, credit notes, debit notes, cancelation entries etc)from XYZ supplier as on 30.06.2021 is 4000000 INR then you will have to update 1000000 INR(5000000 – 4000000) under Exempt. threshold column.

Ideally one PAN should be linked to one company code only. If for different branches you are trying to have different company codes, then section code should be used instead.

The user should still maintain correct withholding tax type and tax code with higher rates if the same is not furnished.

The Key SAP notes related to TDS sec 194Q are as below:

SAP Notes

Below Notes has details of all the notes released for TDS so far.

3032781 – Amendment changes to Section 194Q TDS –Updates

3035980 – Tax deducted at source u/s Section 194Q – Budget 2021 Changes

3060210 – Tax deducted at source u/s Section 194Q – PAN Level Accumulation

3033325 – FAQ on Tax Deducted at Source (TDS) u/s194Q

3044961 – TCS Effective from July 1 2021

3031916 – Amendment to Section 206AB – Updates

Share this Post