In today’s fast-paced business environment, the integration of Enterprise Resource Planning (ERP) systems with banking operations is not just an advantage—it’s a necessity. At our company, we have pioneered the development of real-time API integrations that bridge the gap between ERP systems like SAP, Oracle, Microsoft ERP and various banking institutions and banking functions.

Inbound process in OptiE-Invoice enables organizations to automate and stream line the processing of supplier invoices. It automatically extracts information from any incoming invoice, validates data and transfers it to your ERP (SAP) system. The system validates electronically generated E-Invoices from IRP Portal as well as manual invoices (Hard copy and soft copy). It extracts data, validates with already created Goods receipt, Purchase order etc, highlights discrepancies (if any) and post the data automatically to your ERP(SAP) system( If data matches).

Why Integrate Your ERP System with Banking APIs?

Our Experience and Capabilities

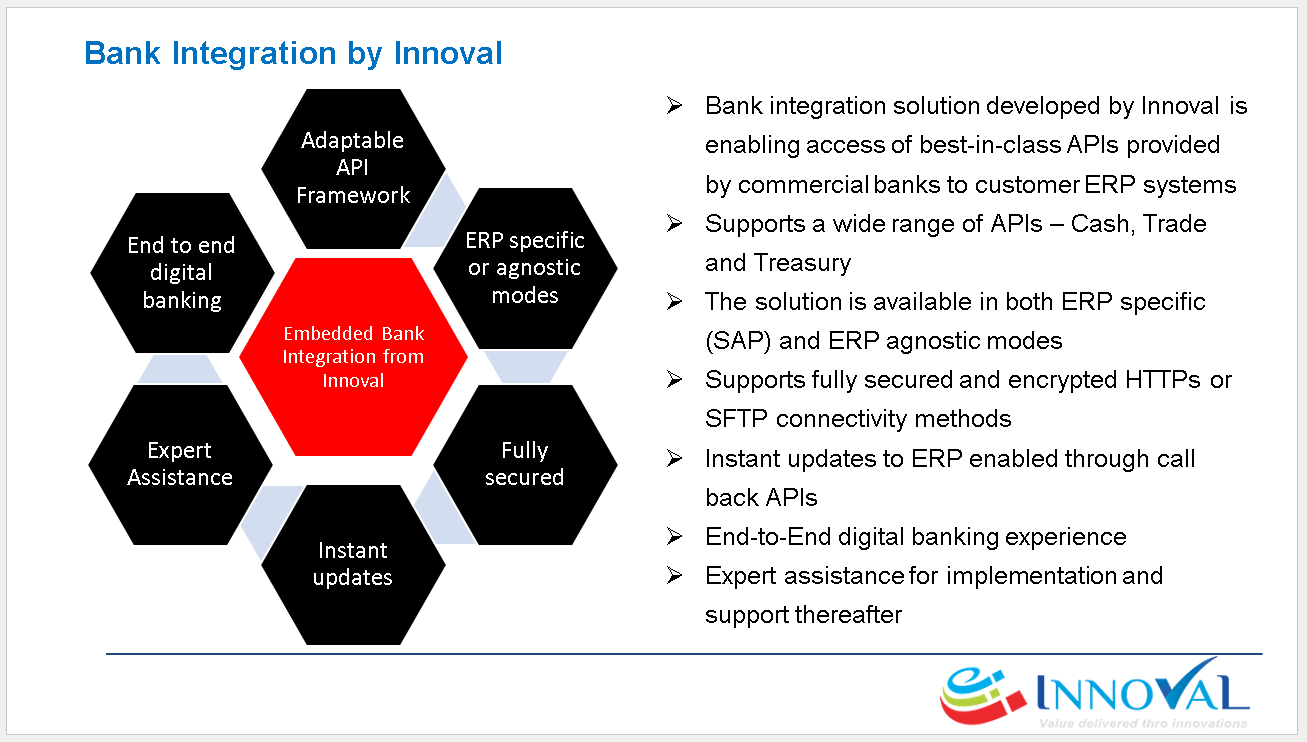

Our extensive experience in integrating various corporate companies with multiple banks has equipped us with unique insights and capabilities. We have successfully implemented solutions that cater to the specific needs of each business, whether it involves integrating our OptiEXIM add-on product for export and import management or facilitating complex financial transactions directly from SAP ERP systems in real time.

One of our notable bank integration framework, OptiBank, provides a unified cockpit interface for managing all bank communications in one place. It seamlessly integrates with SAP ERP, SAP Treasury, Risk Management, and financial modules, enhancing the efficiency of financial operations across multiple banking institutions with real time communications

Case Studies and Success Stories

- Multibank Integration: Our integration framework is a testament to our expertise in multibank connectivity. It supports automated feeds of corporate multibank balances and transactions, API-based direct-to-bank bulk payment processing, and automated cash forecasting, demonstrating significant cost savings and efficiency improvements for large corporate clients.

- Custom Solutions for Trade Finance: By integrating ERP systems with banking APIs or Host-to-Host communications with right data transformation engine for trade finance operations, we have enabled clients to manage Letters of Credit and Bank Guarantees more effectively, reducing turnaround times and improving transactional accuracy.

- Forex and Payment Gateways: We have tailored solutions that handle Forex transactions and connect with payment gateways, providing businesses with the flexibility to manage international trade and e-commerce effortlessly.

Conclusion

The integration of ERP systems with banks through secure API connections is revolutionizing the way businesses manage their financial operations. As leaders in this technology, we continue to innovate and provide solutions that not only meet the current financial demands of businesses but also anticipate future needs. If you’re looking to enhance your ERP capabilities and streamline your banking transactions, our team is ready to assist you with state-of-the-art integration solutions.

#GFF2024 #GlobalFintechFest #FintechInnovation #ERPSystems #DigitalTransformation #SAP #Oracle #MicrosoftDynamics #RealTimeTransactions #InnovalDigitalSolutions #FintechSolutions

Share this Post