What is the best time to identify a defect/ discrepancy?

While there are many technically correct answers to this question, a smart answer doing the rounds is “to find it before it happens”. As the proverb goes “Prevention is better than cure”.

On a similar note, it would be good to ask ourselves: “what is the best time to do Vendor Reconciliation for Input Tax Credit differences?”

Challenges

Most of the large business enterprises having hundreds of vendors struggle with input tax credit process, even if there is an efficient way of posting vendor invoices in their Accounts Payable system.

The impacted KPIs are one or more of the following:

- Non-compliance (availing higher ITC than eligible, resulting in hassles and fines)

- Higher cash outflow towards GST liability (unable to avail eligible ITC)

- Productivity loss (manual processes in reconciliations & follow-up)

- Vendor dissatisfaction (payment delays linked to manual reconciliation)

The typical challenges include:

- Delayed GSTR2A for legitimate reasons

- Some vendors are below the INR 50 Cr turnover and do not do e-invoicing

(e-invoicing does auto-population of draft-GSTR2A) - Some vendors do not do monthly returns filing (they do Quarterly filing)

- Some vendors are below the INR 50 Cr turnover and do not do e-invoicing

- Delayed GSTR2A due to Vendor non-compliance

- Delays in posting vendor invoices in Accounts Payable process

- This can result in higher GST liability month-on-month, and even result in some of the input tax credit getting lapsed after the cut-off date (ITC should be utilized within the same fiscal year or latest by September end of the next fiscal year.

- Differences in the Vendor invoice data (between GSTR2A & Purchase Register)

- Discrepancies in Vendor Returns filing

- Data entry errors under Accounts Payable process

- Discrepancies in vendor master data

- Minor differences in Tolerance or in Vendor invoice numbers

- Special characters, pre-fix/suffix (alphabets / year-strings)

- Clubbing/netting-off of documents

- Vendor invoice amendments after reconciliation is done

- Manual or semi-automated processes

- GSTR2A Fetch & Reconciliation

- Follow-up with vendors

- Vendor payment steps

Coming back to the original question, the word “Reconciliation” is by itself a reactive step. It is true that we cannot do away with Vendor GST Reconciliation in the whole process. However, there must be some smarter way to do things proactively so as to minimise the surprises during the Reconciliation process.

Yes, there is.

GST Reconciliation – Industry Feedback on timeliness

GST Reconciliation – Industry Feedback on quality of data

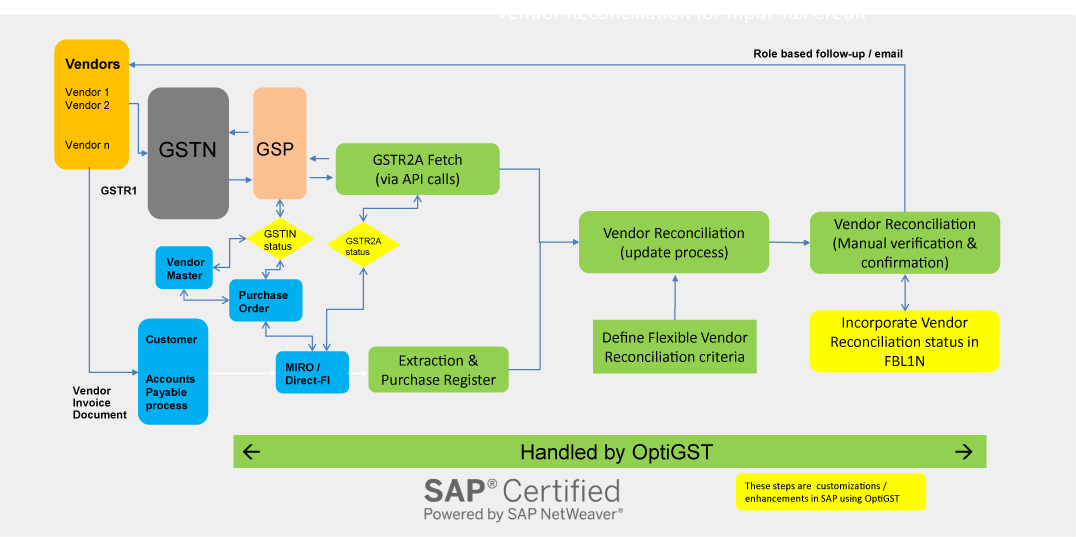

Vendor Reconciliation for Input Tax Credit

Best Practices

It is recommended to have a combination of the following:

A. Efficient reconciliation tools

- GSTR2A & GSTR2B Fetch

- Accurate Purchase Register without manual steps

- Flexible reconciliation features

- Find exact “matches” to the extent possible

- Find “near” matches ignoring permissible differences

- Look for exceptions in GSTN numbers

- Exact match with another vendor GSTIN (same PAN)

- Exact match in GSTR2A of another business place

- Identify “mismatches”, “missing docs”, “excess docs”

- Efficient Reporting

- Reports to identify current compliance status of vendors

- Self-service tools for trouble-shooting

- Information security

- Ready availability of data for future use (without depending on any software solutions provider):

- Analytics

- Automation

- Validation

GSTR2B Reconciliation to identify eligible ITC for current month

B.Smart integration

- Integration of ERP with Govt. Portals via real-time API calls

- Verify the correctness and compliance status of vendors (GSTIN) during:

- Creation of vendor master entries

- Purchase Order Creation

- Invoice-verification

- Continuous delta-fetch of GSTR2A on a daily basis (no need of user involvement)

- Verify the GSTR2A match and filing status of each invoice during:

- Invoice-verification transaction in ERP

- Continuous reconciliation on a periodic basis

- GSTR2A on a daily basis, not just at the end of the month

- Automated emails to vendors with attachments listing discrepancies

- before the vendors file their GST Returns for the preceding month

- without having to download spreadsheets or open emailing software

- Such follow-up can help in getting higher ITC for the month in GSTR2A

- Automation of monthly activities

- GSTR2B Fetch & Reconciliation

- Consider reconciliation of carry-forward documents

- Finalize the ITC to be considered for GSTR3B purposes

- Automated JV creation for reversals and re-credits

- Automated JV creation for ITC utilization against GST Liability

- GSTR2B Fetch & Reconciliation

- Validations in Vendor invoice payment processing

- Custom validations

- Example: Incorporate vendor reconciliation remarks into standard reports like Vendor item display (FBL1N in SAP) for reference before making payments

- Validations should take into account the payment terms & retention-clauses in the PO as well as the Returns filing frequency of the vendor

- Verify the correctness and compliance status of vendors (GSTIN) during:

Vendor GST Reconciliation in SAP for Input Tax Credit – Best Practice

Share this Post