As the business community would be aware, GST Input Tax Credit process in India is undergoing a major change, effective Jan 2022.

However, this is not a surprise either, as the indications were given long back.

Let us look at the recent changes and also at some of the frequently asked questions on this topic.

1. What are the recent changes? Which are the notifications?

| Sr No. | Reference of Sections of Finance Act 2021 | Reference of Sections of CGST Act amended | Remarks |

|---|---|---|---|

| 1 | Section 109 | Section 16 | Additional condition introduced for availing ITC Introduction of Section 16 (2)(aa) Notification #40 notfctn-40-central-tax-english-2021.pdf (cbic-gst.gov.in) Reference to FORM GSTR-2B under sub-rule (7) of rule 60 Input tax credit on invoice or debit note can be availed only when the details of such invoice or debit note have been furnished by the supplier in the statement of outward supplies and such details have been communicated to the recipient as prescribed. Accordingly, provisional credit of additional 5% of credit in GSTR2A will no longer be available for ITC. |

Impact on GSTR2A

There is no change in GSTR2A Fetch or Reconciliation process/reporting. This can be continued for following up with the Vendor on an ongoing basis.

Impact on GSTR3B

The Input Tax Credit in GSTR3B has to be computed based on GSTR2B Fetch/Reconciliation

2. How is GSTR2B different from GSTR2A?

GSTR2B is a static data that does not change over time.

| Comparison | GSTR2A | GSTR2B |

|---|---|---|

| Content |

|

|

| Return Period | From supplier perspective. GSTR2A Return period shows only the supplier’s return period. |

From Recipient perspective. GSTR2B shows both supplier’s return period and recipient’s ITC eligibility period |

| Basic nature | Dynamic Delayed/Quarterly filing by vendors can result in different data in GSTR2A when fetched again for the same period |

Static Backdated filing by vendors will not change the ITC eligibility for the old period. This would be reflected only in current period. |

| Example | If GSTR2A Fetch is done by the recipient for the period Dec 2021 on 15th Jan 2022 or 31st Mar 2022 or 31st Dec 2022, it would probably show different data. | If GSTR2B Fetch is done by the recipient for the period Dec 2021 on 15th Jan 2022 or 31st Mar 2022 or 31st Dec 2022, it would all show exactly the same data. |

| Source of data |

|

Only via GSTR-1 filing. Counterparty filing status would be “Y” (Yes) |

| Data availability | Continuously available | Available only after GSTR1 period is closed |

| Example | GSTR2A for Jan 2022can be fetched any-time even during Jan 2022 itself (data as available on the date from the various sources listed above can be fetched) | GSTR2B for Jan 2022 can be fetched on or after 13th Feb 2022 only |

| ITC eligibility indicator | GSTR2A does not contain an explicit indicator whether ITC can be availed or not. The Recipient has to apply due diligence. | ITC Eligibility would be indicated in GSTR2B (Yes/No). In case of ineligible ITC, the reason for ineligibility would also be mentioned as “P” (place of supply mismatch) or “C” (returns done by vendor for an old period after the cut-off date) |

| ITC consideration | Recipient has to apply due diligence based on supplier filing date in GSTR2A | GSTR2B clearly mentions the recipient’s ITC period |

| Example | If a vendor files GSTR1 for Dec 2021 on 12th Jan 2022, GSTR2A is available to the recipient immediately and the return period in GSTR2A is still Dec 2021 (with supplier filing date as 12-Jan-2022) | If a vendor files GSTR1 for Dec 2021 on 12th Jan 2022, the data would not be available in GSTR2B for Dec 2021. It will get populated in GSTR2B for Jan 2022 only on 13th Feb 2022 only (with supplier’s return period as Dec 2021 and Recipient’s ITC period as Jan 2022) |

GSTR2B Reconciliation to identify eligible ITC for current month

3. If GSTR2B reconciliation is mandatory for input tax credit, should GSTR2A be continued with?

GSTR2A is optional. However, we recommend to continue GSTR2A fetch/recon for the following reasons:

- GSTR2A contains additional information which is not available in GSTR2B:

- B2BA/CDNRA: Amendment indicators (type of amendment, return period of the original document)

- Amended original B2B/CDNR (when GSTR2A is fetched again): Amendment indicators (type of amendment, return period of the amendment document)

- If a vendor amends the recipient GSTIN number, the original recipient will not get a B2BA (neither in GSTR2A nor in GSTR2B), but the original recipient can still know the amendment if the original B2B is fetched again (GSTR2A).

- GSTR3B Status of the vendor against each document

- GSTIN cancellation status/date of the vendor as a column against each document

- Additional sections (TDS, TCS) of data

- GSTR2B comes way too late in the month for any corrective action that can improve the eligible ITC for the month. GSTR2A data can be used for follow-ups on an ongoing basis with vendors before the filing date of the vendor.

- Under the GSTR-1 Submit process, vendors would not be able to change their returns (or add new invoices) after GSTR-1 is submitted.

- Under the upcoming GSTR-1 “Proceed to File(PTF)” process, vendors can still add missed-invoices and re-do the PTF steps till the Filing is closed.

To summarize, GSTR2B is mandatory for compliance while GSTR2A is relevant for vendor follow-up.

4. How is Amendment (B2BA, CDNRA) handled in GSTR2B?

B2BA and CDNRA in GSTR2B are both similar to GSTR2A. However, the amendment type and original return period will not be mentioned in GSTR2B.

The important difference compared to GSTR2A is that GSTR2B contains additional summarized data (vendor-wise summary and overall summary). In the overall summary, the net-effect of amendment would be available. For example, if there are B2BA entries in GSTR2B, the summary section contains the ITC components (CGST, SGST, IGST) with a net-off as below:

(Sum total of ITC in B2BA in current month) – (sum total of ITC in the corresponding original B2B in old period)

Similar is the case for CDNRA.

5. What other challenges can arise in ITC process?

- Cutover (while transitioning from GSTR2A to GSTR2B)

- In case additional ITC has been availed in previous months (either inadvertently or within the allowed provision of 105 %), a one-time reconciliation should be done to identify documents where credit is availed in old period and GSTR2B is available only in current period. This is to ensure that double-credit is not availed for the same document.

- Amendment by vendors for invoices where credit is already availed in an earlier month

- The net effect of amendment should be considered (subtract availed credit from credit in the amendment document)

- Reversals in SAP for invoices where credit is already availed in an earlier month

- If a revised document is available, consider the net-effect on ITC based on the reversals and revised document

- If a revised document is not available, reverse the ITC availed and carry forward the GSTR2B entry

6. Reconciliation by definition is reactive. What are the best practices for smart proactive measures?

- Integration of ERP with Govt. Portals via real-time API calls

- Verify the correctness and compliance status of vendors (GSTIN) during:

- Creation of vendor master entries

- Purchase Order Creation

- Invoice-verification

- Continuous delta-fetch of GSTR2A on a daily basis (no need of user involvement)

- Verify the GSTR2A match and filing status of each invoice during:

- Invoice-verification transaction in ERP

- Continuous reconciliation on a periodic basis

- GSTR2A on a daily basis, not just at the end of the month

- Automated emails to vendors with attachments listing discrepancies

- before the vendors file their GST Returns for the preceding month

- without having to download spreadsheets or open emailing software

- Such follow-up can help in getting higher ITC for the month in GSTR2A

- Install software that can read from vendor email attachments and update the ITC tracker automatically

- Automation of monthly activities

- GSTR2B Fetch & Reconciliation

- Consider reconciliation of carry-forward documents

- Finalize the ITC to be considered for GSTR3B purposes

- Automated JV creation for reversals and re-credits

- Automated JV creation for ITC utilization against GST Liability

- Validations in Vendor invoice payment processing

- Custom validations

- Example: Incorporate vendor reconciliation remarks into standard reports like Vendor item display (FBL1N in SAP) for reference before making payments

- Validations should take into account the payment terms & retention-clauses in the PO as well as the Returns filing frequency of the vendor

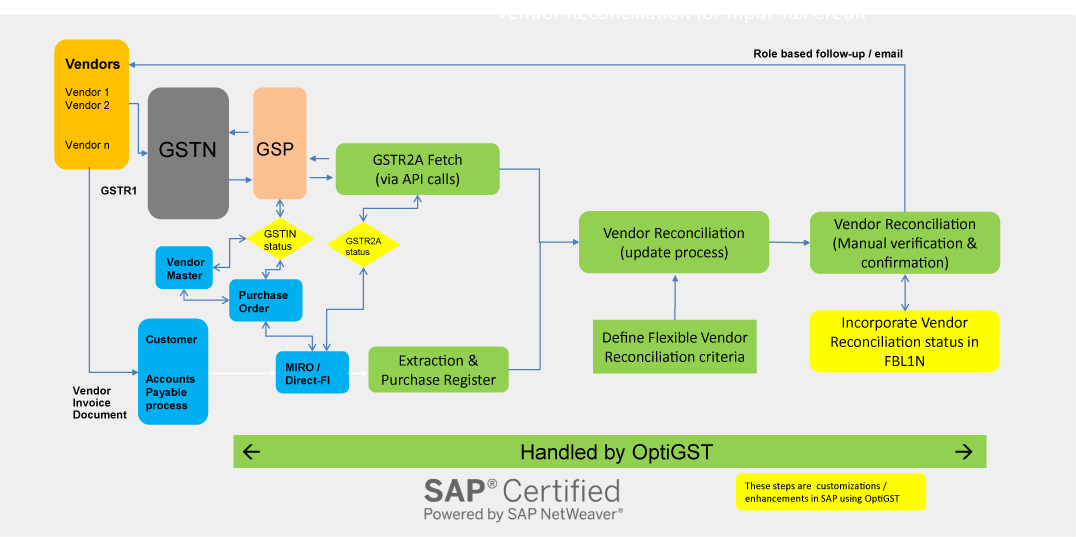

Vendor GST Reconciliation in SAP for Input Tax Credit – Best Practice

Share this Post