E-invoicing got off to a great start in India on 01 Oct 2020. The threshold limit for submitting electronic invoices was progressively lowered from the initial Rs 500 crores to Rs 100 crores turnover since 01 Jan 2021, and then to Rs 50 crores with effect from 01 Apr 2021. Thus as of now, it is mandatory that B2B transactions of companies with an annual turnover greater than Rs 50 Crore are processed through electronic invoices.

One area that has not attracted sufficient attention till now is on how inbound e-Invoices are to be managed by the buyers. What are the concerns to be addressed by companies that receive e-Invoices from their vendors?

Firstly, we need to understand what has changed for the buyer since the introduction of e-Invoices. For one, this opens up the possibility to totally avoid the need for manual data entry, or even the need for tools like Optical Character Recognition (OCR) to enter the details of incoming vendor invoices into what ERP one may be using.

Secondly, the line-items in the PDF or printed invoices will need to be validated by GSTN. Indeed, GSTN approves adjustment of Input Tax Credit (ITC) for buyers only when invoices are authenticated as registered at the GSTN Portal, and electronically signed.

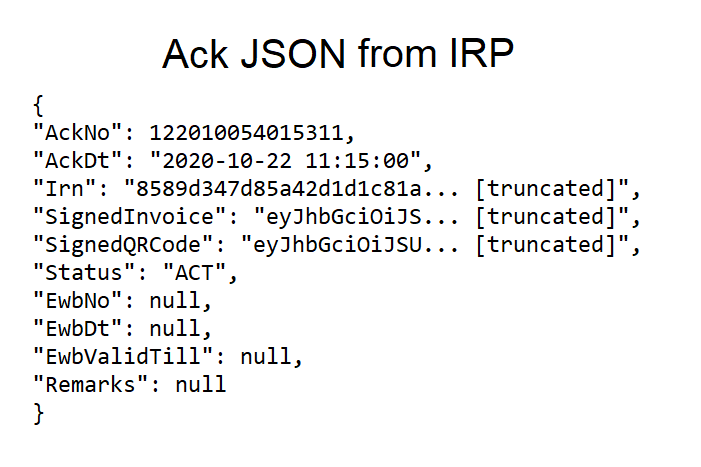

So, how do we validate the registration of e-Invoices by the IRP? One misconception is that an e-Invoice can be validated by scanning the QR Code. In fact, the only way to validate is to refer each e-Invoice to the GSTN. Moreover, the GSTN does not validate an e-Invoice on the basis of IRN/ QR Code. What the GSTN needs to validate an e-Invoice is the “Acknowledgement JSON” (Ack JSON) that the Sellers receive as response from the IRP, whenever they successfully get this is registered and signed. Here is what the Ack JSON looks like:-

As can be seen above, one of the components of the Ack JSON is the “SignedInvoice”. This encrypted component is used by the GSTN to validate the e-Invoice, and to retrieve line item details as registered in their database. Indeed, GSTN computes the ITC entitlement of the buyer based on the CGST/SGST/IGST as entered against registered line items.

IVL’s OptiVIVe product automatically picks up e-Invoices from mail inbox, validates, and retrieves the authenticated line items of e-Invoices direct from the GSTN, along with PDF copies that are digitally signed by NIC-IRP. The digitally signed e-Invoice details are made available to the ERP as JSON, Excel file or dropped in an SFTP folder accessible by the buyer.

Opti-VIVe also provides APIs which can be consumed at the ERP end to retrieve authenticated details of e-Invoices, including line-items and digitally signed PDF Invlices. In other words, the entire process of managing inbound e-Invoices by ERP can be 100% hands free.

OptiVIVe can also process PDF version of e-Invoices without the Ack JSON as above. But these will not be authenticated as accurate by the GSTN. Hence, there remains the risk that ITC may be denied by GSTN.

Thus, it is prudent to insist that vendors (who are mandated to generate e-Invoices) send the Ack JSON as above, along with the PDF copy of the e-Invoice, to a specified email id of the buyer.

Sending the Ack JSON & PDF Invoice to the email id of the buyer (available in the JSON schema) can be automated by the software product used to submit e-Invoice to the IRP. This is a feature built into OptiE-Invoice (On-prem/ Cloud) of Innoval Digital Solutions Pvt Ltd (IVL).

Share this Post