The ability to easily share data with other businesses and with customers is among the most critical drivers for modern, mission-critical business initiatives. API, or Application Program Interface is the software intermediary that allows different software applications to talk to each other.

APIs are all around us, even as many of us may not be unaware of this. When we search at Google for something, or log on to a 3rd party website using Facebook, or make a payment through credit card, the underlying technology that makes all this possible is that of API.

The main benefit of using fully tested APIs is that these enable development of custom applications quickly and with ease. Some of the use cases for which we provide APIs are:-

- Real-time validation of GSTN/ PAN/ eWay Bill status etc

- Real-time services like OCR, Extraction of Invoice Fields, B2C QR Codes etc

- Tracking of movement of goods in transit

- Getting the distance between two PIN

- Getting item details for a given HSN Code

Companies like Google and Amazon have published a library of useful APIs that can be called by applications for face-recognition, getting the latitude and longitude of own location, translation from one language to another and many more.

Agencies of the Government of India too have published useful APIs that can be used by 3rd party applications. These include APIs for filing of e-invoices and eway bills, validating of GST Numbers and so on.

IVL’s API Suite

Innoval Digital Solutions Pvt Ltd offers a suite of APIs that meet almost all typical business needs. After signing up for a single annual subscription plan, businesses can consume any of the APIs as currently available in the Suite, and also the APIs that would be published in the future.

The partial list of available APIs is as indicated in the table below.

|

Category |

Functionality |

Use Case |

|

Content |

Get Locality from PIN Code |

This would be useful to put correct PIN Code while desptaching goods etc |

|

Get PIN Code from Post Office Locality |

When the address does not have a PIN code, or to validate this |

|

|

Get distance between two PIN Codes |

To calculate freight etc |

|

|

Get State Code |

Required to file eInvoices |

|

|

Get Item Details and GST Rate from HSN Code |

Useful while processing inbound Invoices |

|

|

Integration |

Validate PAN |

IT rates apply differentially to those with and without valid PAN. Hence the requirement to validate PAN to compute TDS, TCS etc |

|

Validate if ITR filed |

To compute applicable rate for TDS/ TCS |

|

|

Get Applicable GST Rate from HSN |

As described earlier |

|

|

Platform |

Get authenticated line item details for e-invoice using Signed Ack JSON |

This is to ensure that inbound e-Invoices are registered at the GSTN database |

|

Extract fields from PDF Invoices (both eInvoices/ normal invoices). PDF files with text embedded as image too are extracted |

Addresses the problems of manual data entry for inbound vendor invoice. Without any training specified fields are extracted with 40-50% accuracy. (The accuracy of fields extraction can be increased to 99.9% by availing of the service offered by IVL to "train" based on sample invoices for each vendor layout. This involves additional payment) |

|

|

Validate GSTN |

When an Invoice is received from a new vendor, the GSTN as indicated needs to be validated to ensure correct processing of Input Tax Credit. |

|

|

Get eWayBill Details by Buyer GSTN |

With this API (that takes GSTN of Buyer as input), users can get details all inbound eWay Bills for a given GSTN. eWay Bill Numbers so received can be the input for the next API (Reject eWay Bill). |

|

|

Automatic trigger to extend validity period for eWayBills |

Automate extension of validity period of eWayBills when delivery is delayed,or when vehicle details are changed |

|

|

Reject eWay Bill |

This API can be used by the supplier/recipient in case of eWay Bills generated by the other party or by the transporter (within 72 hours) |

|

|

Generate QR Code for B2C Invoices |

This is a compliance requirement for many companies. Customers can make payments (through UPI etc) by scanning the QR Code |

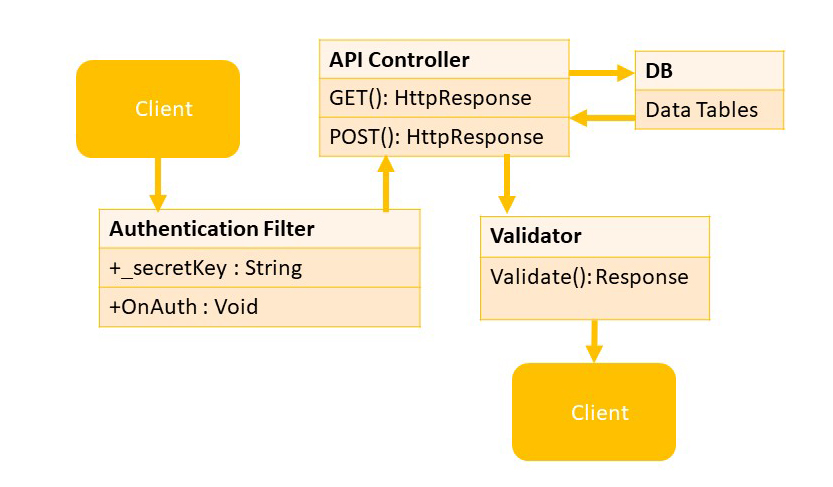

Data Flow: API

Share this Post