Invoice Management System (IMS)

Invoice Management System (IMS) is a facility in GST system, where the invoices/records saved/filed by the supplier in GSTR-1/1A/IFF, can be accepted, rejected or kept pending by recipients in order to correctly avail ITC.

IMS itself is not new. IMS was launched on the GST Portal from 1st October 2024 and has been available to the taxpayers for taking actions on the received invoices/records from 14th October 2024 onwards.

(GST Portal: Dashboard > Services > Returns > Invoice Management System (IMS) Dashboard)

However, IMS took time to stabilize at GSTN. It did have teething issues at GSTN with document duplications and missing documents in GSTR2B.

There were many taxpayers waiting and watching, especially considering what happened to the Simplified GST Returns in 2020.

Thankfully, things have become more stable at the IMS recipient side.

Meanwhile, the 55th GST Council meeting (21st Dec, 2024) and the Finance Bill 2025 (Union Budget) have incorporated IMS as part of the statutory framework.

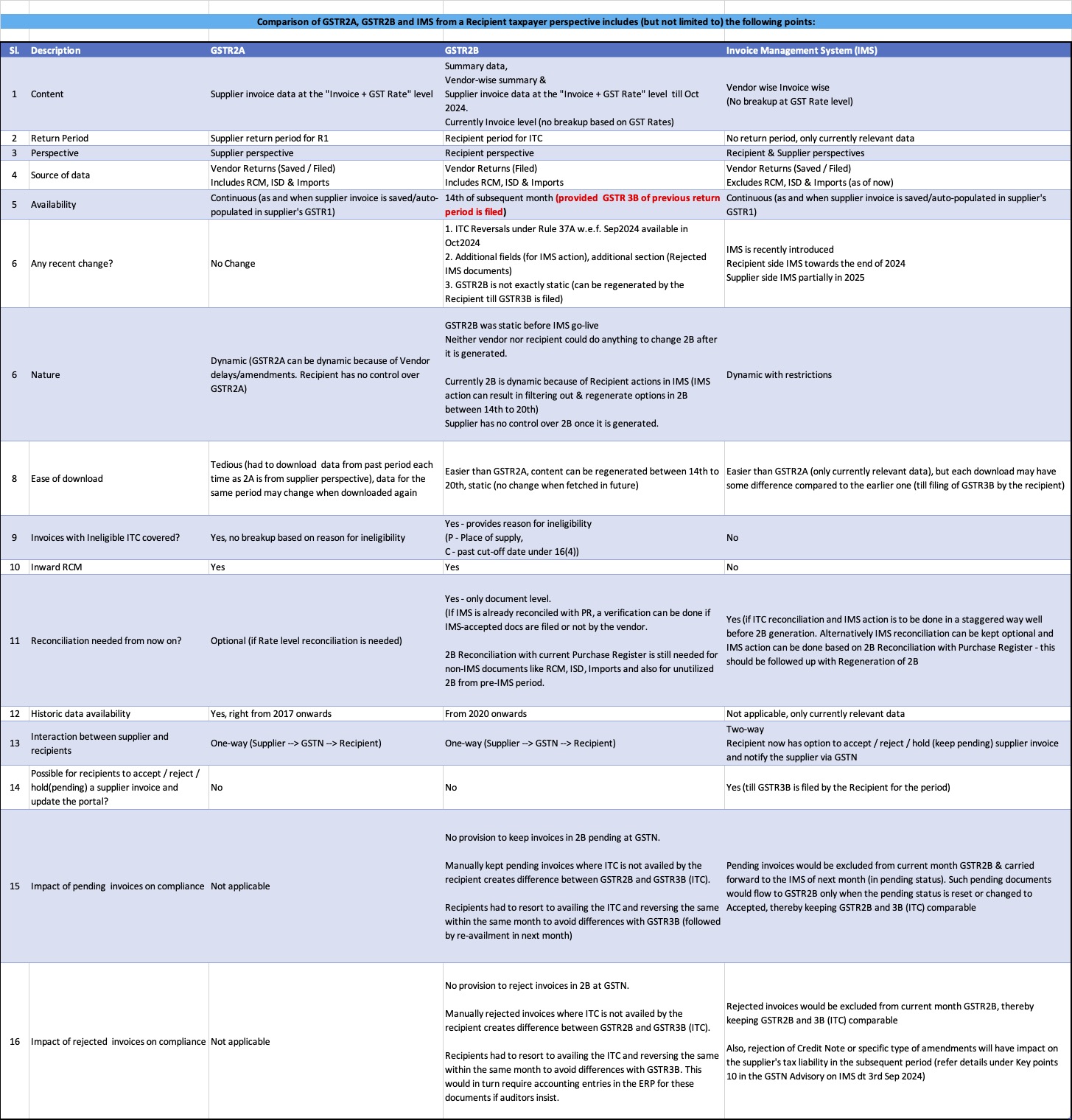

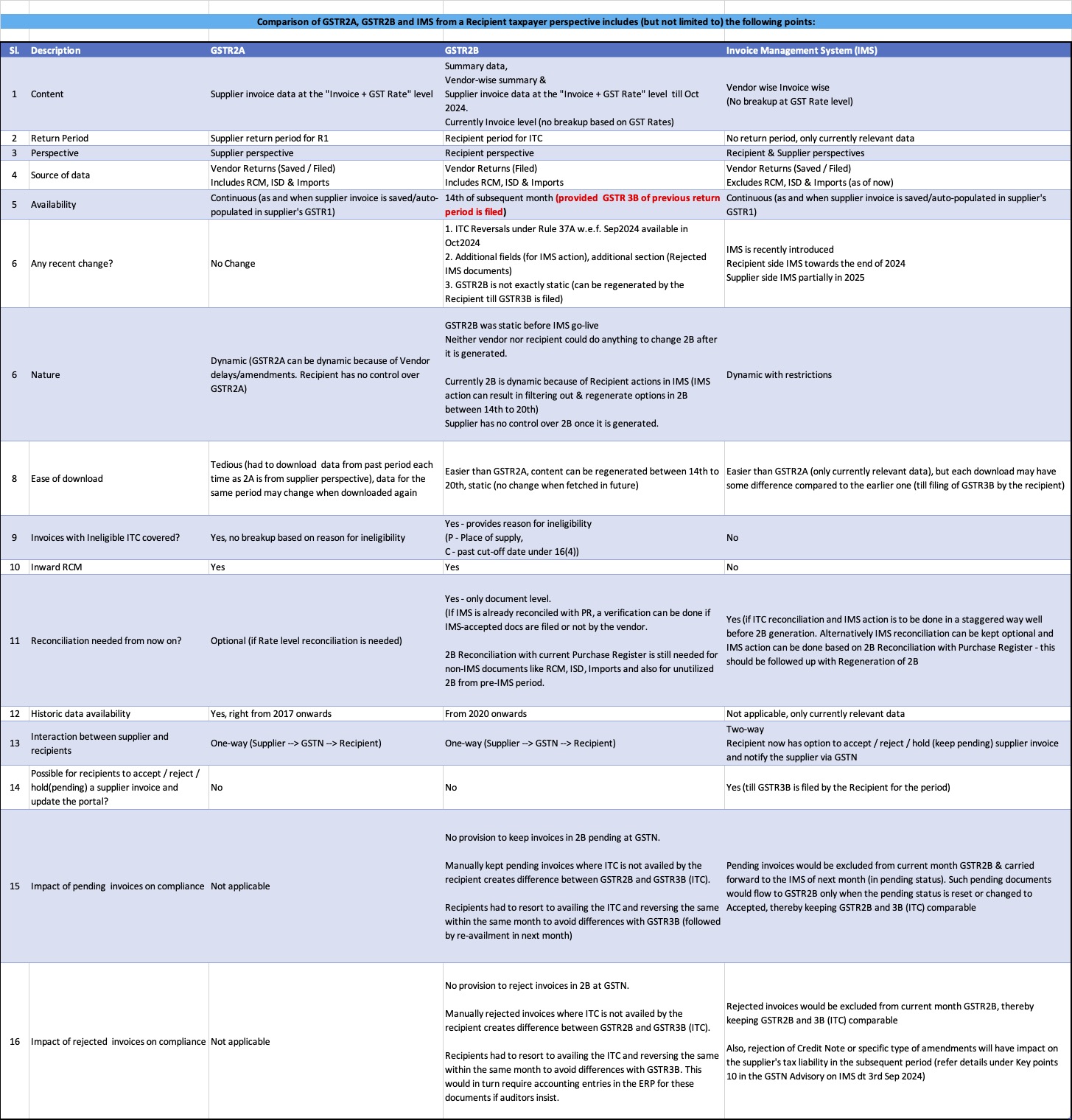

Let us first see where IMS stands in the spectrum of Input Tax Credit where GSTR2A and GSTR2B are well established.

Major Challenges

Most of us might have heard that GSTN has proposed hard-locking of the auto-populated sections of GSTR3B.

It means that the auto-populated liability from GSTR1 / GSTR1A / IFF cannot be edited in GSTR3B, once this proposal becomes effective.

Similarly, the auto-populated Input credit as available in GSTR2B cannot be edited in GSTR3B in the near future.

As things stand, the hard-locking of liability in GSTR3B should not be a major concern for a taxpayer since things are well within the control of the supplier (Impact of Credit Note Rejection by recipient via IMS on the supplier’s GSTR3B is indeed a concern though).

Input Tax Credit in GSTR3B is not exactly under the full-control of the recipient considering the dependency on the vendor filing returns (resulting in ITC month being different from the accounting month in the ledger) and the transit time for goods (resulting in ITC month being different from the GSTR2B month). Any hard-locking of ITC can create extreme challenges to the taxpayers.

It is therefore imperative that the taxpayers start using the IMS without further delays and start action on the vendor documents in the portal: these have to be accepted or rejected or kept pending, so that the auto-populated data need not be edited in GSTR3B.

What happens to the old GSTR2B documents (say an invoice in Aug 2024 GSTR2B) for which ITC was not claimed yet and is being claimed now? These were deemed to be accepted and would not show up in IMS now. It has to be managed in GSTR2B reconciliation before the hard-locking comes into effect.

The other challenge is how to take action on IMS documents.

For taxpayers with more than 500 tax documents in a month, bulk actions cannot be done directly in the portal. It has to be done via integrated tools.

The next challenge is dependency with external agencies.

We know very well that ITC is dependent on vendor filing returns in time.Now we have a new dependency with customers as well. If a customer rejects a credit note in IMS, the supplier’s GST liability in auto-populated 3B will go up next month. How does a supplier know that a customer has rejected an invoice or credit note? It can be seen in the GSTN portal itself under IMS dashboard for the supplier, provided the volume of documents is less. Otherwise, it has to be done through integrated tools.

These were the newly-added challenges. Some of the other well-known challenges from the pre-IMS regime are listed below:

- Stringent timelines – GSTR2B (14th) till GSTR3B (20th)

- Manual processes / follow-ups with vendors

- Missing docs / Mismatches (surprises impacting reconciliation)

- Amendments by Vendors

- Cancellations / Reversals in Books

- Manual payment controls / PO release strategy

- Time-barring: ITC u/s 16(4)

- ITC Reversals under Rule 37 (non-payment to vendors) and 37A (non-filing of GSTR3B by vendor) & subsequent re-availing

Impact on Business (if these challenges are not addressed as part of an integrated process)

- Higher cash outflow towards GST liability

- unable to avail eligible ITC within time, interest loss

- Unable to forecast GST payments under GSTR3B, in advance

- Non-compliance

- GST Notice / Litigation (liability discharged / ITC availed)

- Delay in GSTR 3B

- Productivity loss

- manual processes in reconciliations, follow-up & response to Notices / Audit-queries

The most important point here for a CXO is the cost of non-compliance.

For the CFO, it could be litigation and notices from GSTN

For the CEO, it could be the branding itself. With the advent of information at fingertips, the business partners can easily know if there is a delay in GSTR-3B filing and the impact is not just penalty or interest but also the perception by prospects wanting to do business with another taxpayer.

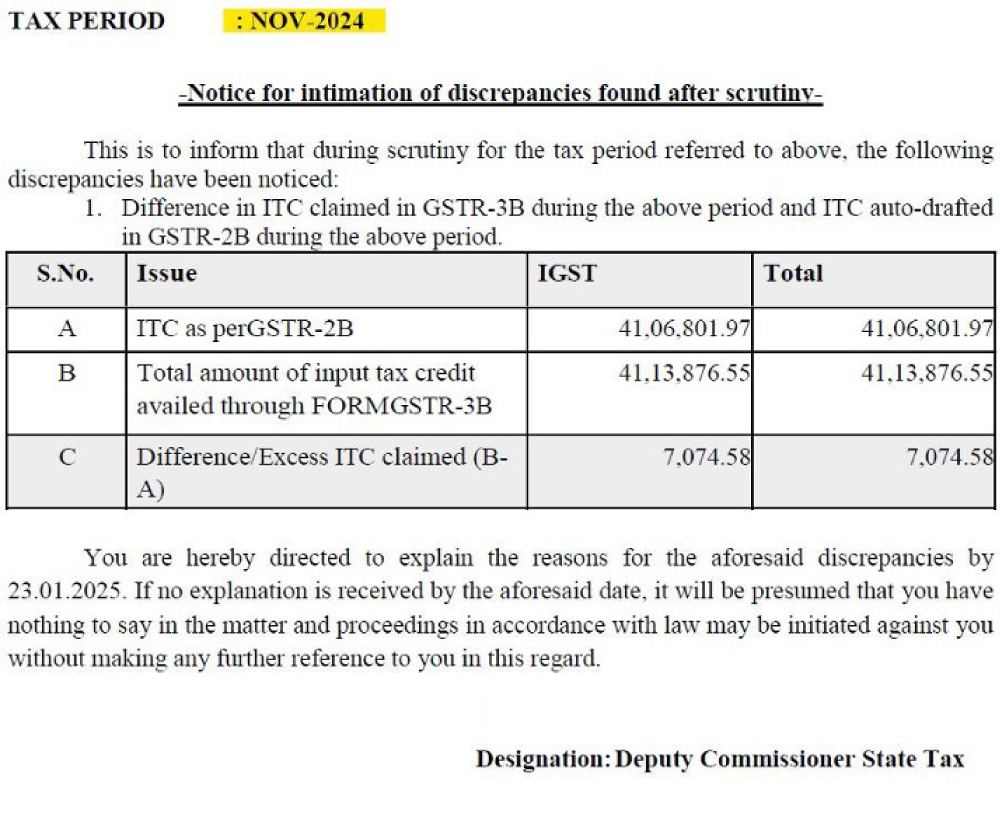

Let us look at one specimen Notice issued by GSTN – see the wordings “proceedings may be initiated” and also the timing (discrepancy for November 2024 GSTR3B filed in December 2024 identified in same month and explanation to be provided by 23-Jan-2025).

We used to think that such notices would come after a year or two.

We used to think that such notices would come after a year or two.

No, it is happening fast.

In this case, the recipient has availed ITC of INR 41.13 Lacs (approx.) under GSTR3B for Nov 2024. This was seen by GSTN to be in excess of the ITC in GSTR2B for the corresponding period by INR 7,074.58.

One of the supplies was physically received only in November and hence ITC was availed in November whereas this ITC is not part of November 2B (it was part of October 2B).

The recipient had not used IMS in Oct 2024 to keep this supplier document pending and this document was deemed to have been accepted under October GSTR2B. However, the recipient did not avail ITC for this invoice in October GSTR3B and instead availed the same in November.

Ideally such cases should be marked as pending in IMS before 3B is filed.

Of course, there are taxpayers who have been managing this indirectly by a combination of availing, reversal and reclaims but that has no traceability in the GSTN portal.

The kind of manual effort that goes into reconciliations, follow-up with vendors and litigations is a cause of worry, when this effort can be utilized for more creative activities

Innoval offers you IMS under OptiGST umbrella.

OptiGST (SAP Add-On) to leverage IMS:

OptiGST has options to fetch (& report) IMS data from the portal, reconcile IMS data with Purchase Register and provide options for individual/bulk IMS actions.

It helps to save time and money by early and accurate reconciliation, minimize hassles (same ITC in GSTR2B &GSTR3B)

OptiGST provides flexible options for staggered reconciliation on a delta basis (IMS with Purchase Register) and/or one-time reconciliation of GSTR2B with Purchase Register followed by IMS actions (acceptance/rejection/pending) and recomputing of GSTR2B.

The solution provides option for Bulk actions in IMS at the click of a button (Acceptance, Rejection, Pending, Reset). It also identifies documents with exact match or acceptable differences and proposes bulk acceptance based on configurations. The solution also identifies and proposes documents that can be kept pending (bulk action). There are options to send bulk emails to vendors for documents missing in the portal, with configurable parameters for email body, attachment, sender and recipients.

The solution also handles validation of IMS actions in a configurable way.

Innoval is releasing the next version of OptiGST IMS by April 2025 to handle the Supplier side IMS, wherein a supplier can identify if their invoice is rejected by a customer and then decide on the next steps (whether to issue credit note or request the customer to reconsider their IMS action). Similarly, information on credit note rejections by a customer can be helpful to plan the next steps on GST liability and accounting entries.

Data Security – Data resides within the customer landscape with access control by the customer’s security team. There is no need for separate user logins / user management / data management / backup / Disaster Recovery steps as the solution and data are integrated components of the customer’s SAP landscape. Encryption/Decryption are done within the SAP landscape itself.

Integration (with P2P process in SAP as well as Govt. Portals)

There is no need for any manual steps: No data entry, no download/upload, no offline tool, no spreadsheet, no Json, no outlook – these can be done by click of a button, that too, from within SAP.

There are integrated IMS cockpits and reporting options with download facilities for users based on roles and responsibilities.

Best practices – Custom validations / automations / controls / email notifications / workflows

For more details, please feel free to request for a meeting/demo.

Download Brochure

Refer page 66-67

- Amendment of section 34

In section 34 of the Central Goods and Services Tax Act, in sub-section (2), for the proviso, the following proviso shall be substituted, namely: –

“Provided that no reduction in output tax liability of the supplier shall be permitted, if the–

- input tax credit as is attributable to such a credit note, if availed, has not been reversed by the recipient, where such recipient is a registered person; or

- incidence of tax on such supply has been passed on to any other person, in other cases.”.

- Amendment of section 38

In section 38 of the Central Goods and Services Tax Act, –

- in sub-section (1), for the words “an auto-generated statement”, the words “a statement” shall be substituted;

- in sub-section (2), –

- for the words “auto-generated statement under”, the words “statement referred in” shall be substituted;

- in clause (a), the word “and” shall be omitted;

- in clause (b), after the words “by the recipient,”, the word “including” shall be inserted;

- after clause (b), the following clause shall be inserted, namely: – “(c) such other details as may be prescribed.”.

Refer D7 (Page 7):

Amendment in CGST Act, 2017 and CGST Rules, 2017 in respect of functionality of Invoice Management System (IMS)

The GST Council recommended inter-alia:

- To amend section 38 of CGST Act, 2017 and rule 60 of CGST Rules, 2017 to provide a legal framework in respect of generation of FORM GSTR-2B based on the action taken by the taxpayers on the Invoice Management System (IMS).

- To amend section 34(2) of CGST Act, 2017, to specifically provide for requirement of reversal of input tax credit as is attributable to a credit note, by the recipient, to enable the reduction of output tax liability of the supplier.

- To insert a new rule 67B in CGST Rules, 2017, to prescribe the manner in which the output tax liability of the supplier shall be adjusted against the credit note issued by him.

- To amend section 39 (1) of CGST Act, 2017 and rule 61 of CGST Rules, 2017 to provide that FORM GSTR-3B of a tax period shall be allowed to be filed only after FORM GSTR-2B of the said tax period is made available on the portal.

Refer C.2 (Page 7)

- Invoice Management System and new ledgers:

The Council also took note of the agenda on the enhancements being made to the existing GST return architecture. These enhancements include the introduction of a Reverse Charge Mechanism (RCM) ledger, an Input Tax Credit Reclaim ledger and an Invoice Management System (IMS). Taxpayers would be given the opportunity to declare their opening balance for these ledgers by 31st October 2024.

IMS will allow the taxpayers to accept, reject, or to keep the invoices pending for the purpose of availment of Input Tax Credit. This will be an optional facility for taxpayers to reduce errors in claiming input tax credit and improve reconciliation. This is expected to reduce notices issued on account of ITC mismatch in the returns