For Business Enterprise

Integrated E-invoicing System for SAP ECC/S4 HANA system users for India

What is

Read more

E-invoicing of India?Ready to

Read more

start free trial?Like to

Email Brochure

know more about?

- The Indian government has announced introduction of ‘E-Invoicing’ or ‘Electronic Invoicing’ for reporting of business to business (B2B) invoices to GST System, starting from 1st January 2020. It is important that your current ERP system (Like SAP) accordingly allows you to seamlessly generates, submits and files E-Invoices into government portal without additional or manual data entry. The generated E-Invoice follows standard that is also machine readable and will have uniform interpretation across various stakeholders and the whole business ecosystem. This is a statutory requirement for all business processes to be compliant as per stipulated regulation from the government.

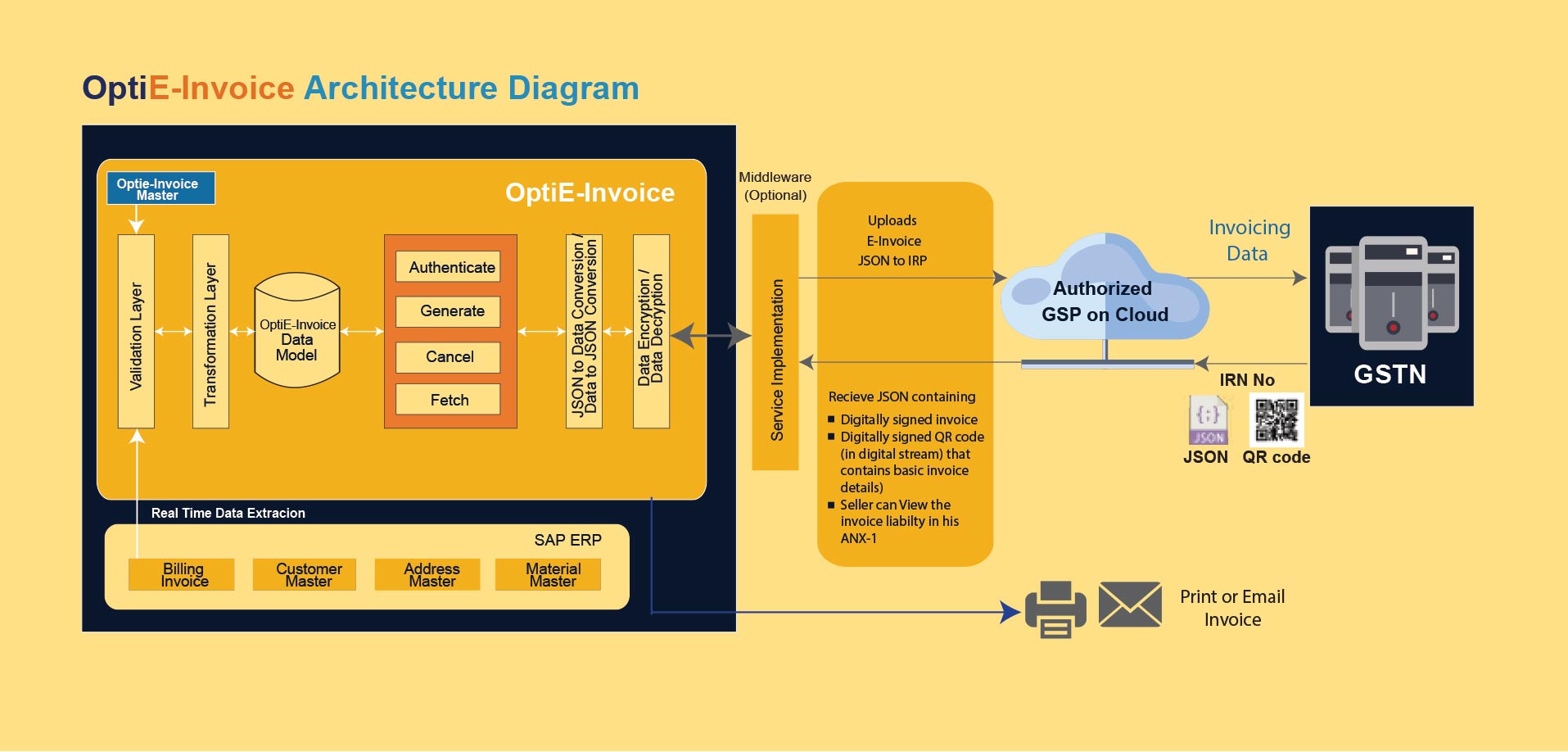

- OptiE-Invoice allows generation of E-Invoice, transmit to Invoice Registration Portal (IRP) via authorized” GSP and receive a unique Invoice Reference Number (IRN), digitally signed E-Invoice and QR code.

Online API Integration

-

On-Premise, SAP Add-On

- No additional hardware, No cloud subscription

- No additional cost for DB Administration

- No conflict with SAP or custom objects (separate namespace)

- Integration with SAP

Flexible architecture

- Extensive configuration options, easy to maintain

- No additional cost for DB Administration

- Best practices on Custom-Enhancements

- Facilitates smooth upgrades and management of customizations

-

Security

- Authorization

- Data Encryption

User friendliness

- No need to log in to any other system or portal for E-Invoice generation

Dedicated Product team to handle statutory changes, if any by Govt.

Dedicated helpdesk team for SLA-driven support under AMC